The above picture is a former homeowner on eviction day. His family owned the home in which he was evicted for nearly 50 years.

The property owner was evicted from his home after a property tax foreclosure was ordered in Cuyahoga County, Ohio. The tax lien holder was Plymouth Park Tax Services, a subsidiary of J. P. Morgan Chase.

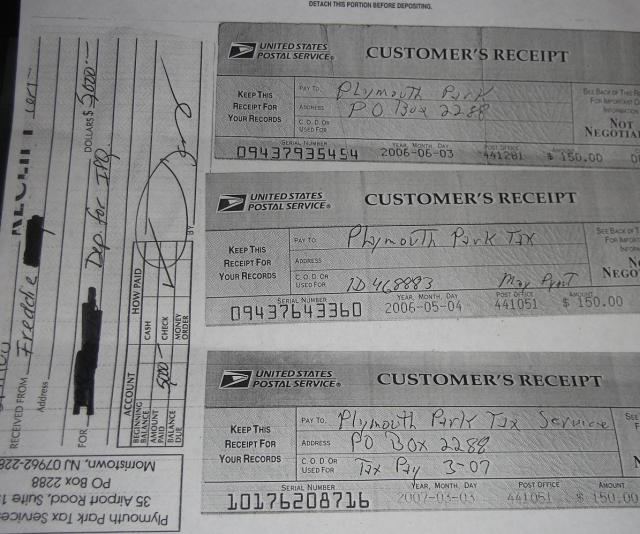

The homeowner lost his home - owned for nearly 50 years- for property tax arrears in the amount of $2,000, despite paying nearly $6,000 to Plymouth Park Tax Services, aka Xspand, towards the arrearage and in an effort to settle this case.

(see copies of the payments below)

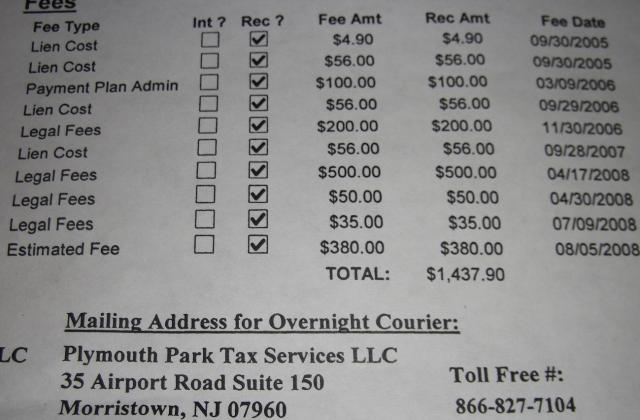

Below are copies of the excessive fees issued by Plymouth Park Tax Services, aka Xspand, subsidiaries of J.P. Morgan Chase

Below are photos of the property tax foreclosure victim also on eviction day. The mentally ill victim is looking out his door after realizing that representatives from Plymouth Park Tax Services were knocking on his door- to kick him out of his home owned for nearly 50 years.

Unfortunately, due to the victim's mental health status, he was not fully aware of what was about to happen and did not pack or move any of his belongings prior to the knock on his door.

The former homeowner now resides in a homeless shelter.

The victim leaving his home owned for nearly fifty years- for the last time.

There was highly suspicious activity regarding the purchase of the above victim's property. The victim's friends offered to pay off the tax lien in order to save the homeowner's house. Plymouth Park Tax Services refused the offer and sold the property for $7,500. The purchase of this property was intended to benefit the nephew of the new owner. The nephew wanted the house to start a business working with the County Landbank to maintain the yards of properties in the County Landbank.

The photo below is of the victim's house, along with two other properties.

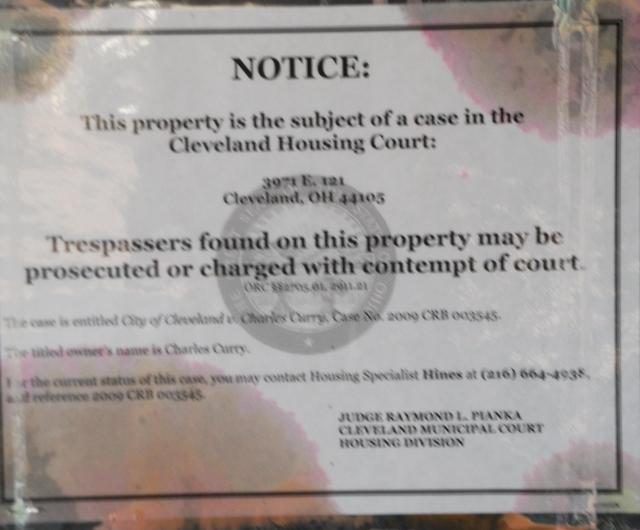

The victim's home was in control of Plymouth Park Tax Services, the second house was in control of Cleveland Housing Court:

And the third house pictured was in control of Safeguard Properties:

Another example of this scam and other victims:

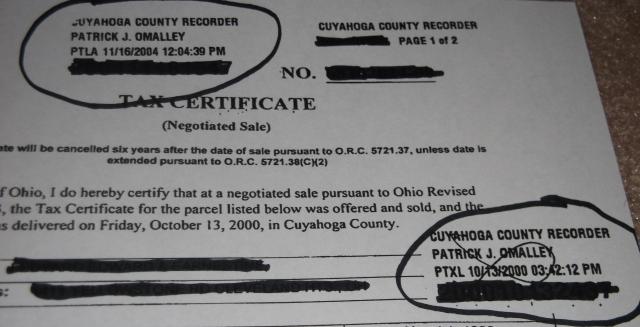

Below are copies of suspicious property tax liens that have already cost the homeowners (senior citizens) their property.

However, there is a pending civil lawsuit regarding these suspicious liens. The homeowners have requested privacy, so all of the information identifying the homeowners has been redacted.

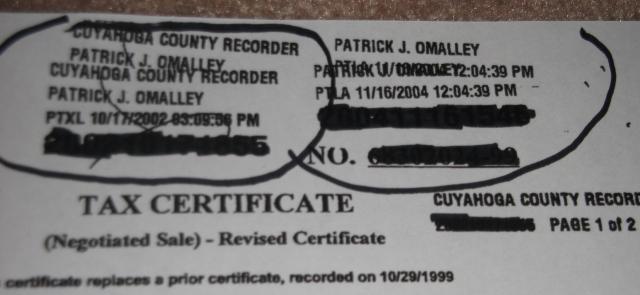

Notice in the above photo (circled areas) that the original tax lien was filed on 10/13/2000, with the time stamp date simply crossed out, and refiled again on 11/16/2004- four years later.

The reason for this suspicious refiling is because the tax liens are cancelled after six years, according to O.R.C. 5721.37

The tax foreclosure was filed on November 7, 2007- which would have made the above tax lien , originally dated October 13, 2000, invalid due to time limitations.

Above is another copy of a second tax lien, relative to the same property, which was time stamped on 10/17/02 , original date crossed out, and refiled again on 11/16/2004- two years later.

The following pictures are of three additional victims. All three of these families have lost their mortgage free homes to Plymouth Park Tax Services, aka Xspand, aka J. P. Morgan Chase.

All three of these houses were each owned for decades.

The Ali family

Tim Pickett

Darren Johnson

Cuyahoga County is under a massive federal corruption investigation which publicly began in 2008. Search warrants were isssued for the homes and offices of several public officials.

The ongoing investigation has resulted in numerous convictions and pending federal charges. I believe that Plymouth Park Tax Services is directly involved with the county corruption.

I am not the only person that was suspicious of this company and county officials:

According to former Mayor Eric Brewer via Cleveland.com: [15]

Gus Frangoes never called me. I do, however, understand Jim Rokakis' oft-handed comments.

I wrote him a letter in 2006 asking that he not sell anymore properties through third-party tax lien sales to GLS Capital and Plymouth Park Investments out of East Cleveland. Mayor Frank Jackson had also asked him not to sell tax liens from Cleveland.

I was critical of Rokakis pushing this blight-causing deal in 1999 when I hosted a radio show on WERE. I think it's absolutely horrible how he, as an elected official, pushed for a tax lien sale state law that created blight in East Cleveland by letting third party investors sit on vacant properties without cutting the grass, boarding them up, maintaining or rehabilitating them. If Steve Litt wants to write a real story, investigate Rokakis' third party tax lien sales and the impact they've had on school district budgets. He claimed it helps the schools but empty houses don't generate property taxes. Rokakis' policies have done much to decimate the East Cleveland school district's budget and that of every other community in Cuyahoga County where he's been selling tax liens to third party investors.

I had some blocks with 37 properties and 25 delapidated vacancies. Every year we had to divert general fund and HUD dollars from other purposes just to take care of abandoned properties. Go to Rokakis' website. He won't update the "tax lien certificate sales" information past 2006 because it will show just how his policies have devasted the county. Through 2006 it shows he sold the tax liens to 22912 properties from East Cleveland, Cleveland and other cities throughout the county. How many tax liens has Rokakis sold over the past four years? That's the number he's hiding from the public. He has refused to allow the individual tax delinquent homeowner to buy their own tax lien at up to a 30 percent discount, but he sells their tax lien to a third-party for that amount. Steve Litt. This is the real story.

________________________________________________________________________________________________________________________________________________________________________________

Former Cuyahoga County Treasurer - Jim Rokakis- has given this company no competition - no bid- land grabs since 2004. story [16]

Jim Rokakis also gave Plymouth Park Tax Services a $50,000 grant to "study" delinquent property tax liens in Cuyahoga County.

Jim Florio, the former Governor of New York, is politically connected and is also the former owner of Plymouth Park Tax Services, aka Xspand.

Xspand, which was founded by former New Jersey Governor James Florio in 2000, was acquired by Bear Stearns Cos. six years later. Also known as Plymouth Park Tax Services, it became part of JPMorgan when the New York-based bank took over Bear Stearns in 2008 to prevent a collapse.

James Joseph "Jim" Florio (born August 29, 1937) is a Democratic politician who served as the 49th Governor of New Jersey from 1990 to 1994, the first Italian American to hold the position, and the first incumbent governor of the Garden State to fail of re-election

link to story [17]

After I began my investigation into Plymouth Park Tax Services and the thousands of property tax foreclosures filed in Cuyahoga County, I discovered that Plymouth Park Tax Services was delinquent with paying their own property taxes on nearly 100 properties obtained via a delinquent tax foreclosure.

Below is a list of all the property that was owned by Plymouth Park Tax Services and the delinquent property taxes owed at the time of my investigation. Many of the deliquent taxes were owed to the county for well over one year and the properties were also owned by Plymouth Park Tax Services during this time period:

1. 1613 Elberon Ave, East Cleveland, OH 44112 delinquent taxes $2,053.47

2. 4150 E 138 St, Cleveland, OH 44105 delinquent taxes $1,592.59

3. 13909 Orinoco Ave, East Cleveland, OH 44112 delinquent taxes $1,568.73

4. 890 E 130 St, Cleveland, OH 44108 delinquent taxes $2,917.99

5. 13215 Alvin Ave, Garfield Hts, OH 44105 delinquent taxes $2,331.27

6. 1516 Luxor Rd, East Cleveland, OH 44112 delinquent taxes $1,297.17

7. 12414 Farringdon AVE, Cleveland, OH 44105 delinquent taxes $2,411.11

8. 1061 E 167 ST, Cleveland, OH 44110 delinquent taxes $2,090.81

9. 3234 W 88 St, Cleveland, OH 44102 delinquent taxes $1,608.16

10. 1622 E 84 St, Cleveland, OH 44103 delinquent taxes $2,667.86

11. 11806 Fairport Cleveland, OH 44108 delinquent taxes $1,451.10

12. 14113 Tokay AVE, Maple Hts, OH 44137 delinquent taxes $2,773.79

13. 11902 Fairport Cleveland, OH 44108 delinquent taxes $1,446.14

14. 14113 Tokay AVE, Maple Hts, OH 44137 delinquent taxes $ 2,773.79

15. 11902 Fairport Cleveland, OH 44108 delinquent taxes $1,446.14

16. 3529 East BLVD, Cleveland, OH 44105 delinquent taxes $3,253.54

17. 12904 Dove AVE, Cleveland, OH 44105 delinquent taxes $6,479.00

18. 13619 Christine AVE, Garfield Hts, OH 44105 delinquent taxes $5,581.56

19. 9607 Parmelee Ave, Cleveland, OH 44108 delinquent taxes $1,216.22

20. 10805 Earle Ave, Cleveland, OH 44108 delinquent taxes $2,451.29

21 805 E 131 ST , Cleveland, OH 44108 delinquent taxes $1,612.16

22. 3877 E 142 St, Cleveland, OH 44128 delinquent taxes $3,827.72

23. 3780 Mayfield RD, Cleveland Hts, OH 44121 delinquent taxes $10,164.97

24. 4046 Northfield Rd, Highland Hills Village, OH 44122 delinquent taxes $3,678.81

25. 24275 Donover Rd, Warrensville Hts, OH 44128 delinquent taxes $3,217.43

26. 15127 Granger RD, Maple Hts, OH 44137 delinquent taxes $6,291.79

27. 19919 Mountville Dr, Maple Hts, OH 44137 delinquent taxes $3,003.55

28. 3625 Washington BLVD, Cleveland Hts, OH 44118 delinquent taxes $5,174.37

29. 942 Pembrook Rd, Cleveland Hts, OH 44121 delinquent taxes $12,557.41

30. 1282 E 186 St, Cleveland, OH 44110 delinquent taxes $1,844.77

31. 4002 Trent AVE, Cleveland, OH 44109 delinquent taxes $2,015.08

32. 10321 Parkgate AVE, Cleveland, OH 44108 delinquent taxes $2,855.04

33. 11316 Durant AVE, Cleveland, OH 44108 delinquent taxes $7,981.65

34. 27701 Mills AVE, Euclid, OH 44132 delinquent taxes $2,232.32

35. 12325 Park Knoll Dr, Garfield Hts, OH 44125 delinquent taxes $1,818.64

36 13408 S Parkway DR, Garfield Hts, OH 44105 delinquent taxes $2,394.20

37. 4673 E 85 St, Garfield Hts, OH 44125 delinquent taxes $3,476.40

38. 13421 Emerson Ave, Lakewood, OH 44107 delinquent taxes $4,547.51

39 4072 E 139 ST, Cleveland, OH 44105 delinquent taxes $873.58

40 4344 E 141 ST, Cleveland, OH 44128 delinquent taxes $5,186.68

41. 4115 E 146 ST, Cleveland, OH 44128 delinquent taxes $1,362.21

42. 16205 Judson Dr, Cleveland, OH 44128 delinquent taxes $953.36

43. 19807 Longbrook RD, Warrensville Hts, OH 44123 delinquent taxes $2,376.01

44. 16105 Mendota AVE, Maple Hts, OH 44137 delinquent taxes $11,011.57

45. 16305 Friend Ave, Maple Hts, OH 44137 delinquent taxes $3,019.45

46. 19819 Kings HWY, Warrensville Hts, OH 44122 delinquent taxes $8,283.79

47. 3608 Palmerston RD, Shaker Hts, OH 44122 delinquent taxes $28,184.22

48. 5110 Philip St, Maple Hts, OH 44137 delinquent taxes $2,671.00

49. 19107 Gladstone Rd, Warrensville Hts, OH 44122 delinquent taxes $2,523.68

50. 3651 Latimore Rd, Shaker Hts, OH 44122 delinquent taxes $8,767.02

51. 1983 Warrensville Center RD, South Euclid, OH delinquent taxes $13,136.66

52. 2236 Edgerton Rd, University Hts, OH 44118 delinquent taxes $5,888.70

53 3388 Cedarbrook Rd, Cleveland Hts, OH 44118 delinquent taxes $3,845.20

54. 1164 Melbourne RD, East Cleveland, OH 44112 delinquent taxes $4,690.15

55. 907 Caledonia AVE, Cleveland Hts, OH 44112 delinquent taxes $7,444.12

56. 1680 Beverly Hills DR, Euclid, OH 44117 delinquent taxes $3,367.92

57. 25570 Tungsten RD, Euclid, OH 44132 delinquent taxes $3,231.96

58. 3967 E 121 St, Cleveland, OH 44105 delinquent taxes $3,357.74

59. 12528 Forest AVE, Cleveland, OH 44120 delinquent taxes $5,887.51

60. 3920 E 99 St, Cleveland, OH 44105 delinquent taxes $1,318.11

61. 9601 Heath AVE, Cleveland, OH 44104 delinquent taxes $1,203.47

62. 7812 Force AVE, Cleveland, OH 44105 delinquent taxes $1,930.77

63. 3279 E 130 ST, Cleveland, OH 44120 delinquent taxes $2,536.84

64. 1237 E 114 ST, Cleveland, OH 44108 delinquent taxes $2,351.40

65. 1827 Haldane RD, Cleveland, OH 44112 delinquent taxes $4,986.37

66. 16910 Grovewood Ave, Cleveland, OH 44110 delinquent taxes $2,043.33

67. 13417 Rugby RD, Cleveland, OH 44110 delinquent taxes $2,365.97

68. 15720 Mandalay Ave, Cleveland, OH 44110 delinquent taxes $1,855.10

70. 1998 Torbenson DR, Cleveland, OH 44112 delinquent taxes $3,877.43

71. 763 E 152 ST, Cleveland, OH 44110 delinquent taxes $12,565.98

72. 794 E 154 St, Cleveland, OH 44110 delinquent taxes $812.14

73. 341 E 156 St, Cleveland, OH 44110 delinquent taxes $8,262.92

74. 807 E 131 St, Cleveland, OH 44108 delinquent taxes $1,283.44

75. 1373 EAST BLVD CLEVELAND, OH 44106 delinquent taxes $3,993.51

76. 2850 E 127 ST, Cleveland, OH 44120 delinquent taxes $2,200.59

77. 4001 E 151 ST, Cleveland, OH 44120 delinquent taxes $4,794.80

78. 16201 Myrtle AVE, Cleveland, OH 44128 delinquent taxes $4,100.27

79. 3546 Raymont BLVD, University Hts, OH 44118 delinquent taxes $16,666.01

80. 861 Quarry DR, Cleveland Hts, OH 44121 delinquent taxes $18,367.91

81. 22701 Shore Center AVE, Euclid, OH 44123 delinquent taxes $33,336.34

82. 3962 E 41 ST, Newburgh Hts, OH 44105 delinquent taxes $7,703.00

83. 1521 Clarence AVE, Lakewood, OH 44107 delinquent taxes $15,719.32

84. 4328 E 143 ST, Cleveland, OH 44128 delinquent taxes $2,975.68

85. 3769 E 140 ST, Cleveland, OH 44120 delinquent taxes $6,851.10

86. 3279 E 128 ST, Cleveland, OH 44120 delinquent taxes $3,700.37

87. 7915 Sowinski AVE, Cleveland, OH 44103 delinqent taxes $13,719.84

88. 1642 Lockwood CLEVELAND, OH 44112 delinquent taxes $2,799.55

89. 857 E 75 ST, Cleveland, OH 44103 delinquent taxes $735.91

How could this company file thousands of delinquent property tax foreclosures when they were not paying their own taxes on properties on which they foreclosed?

J. P Morgan Chase has been given billions of tax payer dollars as an incentive to work with families to avoid foreclosures. In one hand, J. P Morgan Chase took the financial incentive from the government, and with the other hand they filed tens of thousands of tax lien foreclosures forcing people from their homes for a couple thousand dollars owed in delinquent property taxes.

In 2006, in an apparent scheme to expedite the delinquent property tax foreclosure process to possibly benefit Plymouth Park Tax Services, Jim Rokakis initiated an accelerated foreclosure process that expedited the time frame for certain foreclosures - including delinquent property tax foreclosures- reducing the time from several years to only a few months:

Accelerated Foreclosure Cases Filed

The program stems from a new state law that allows counties to bypass the normal court process and carry out a foreclosure administratively, reducing the time it takes to foreclose from two-plus years down to as little as three months. County Treasurer Jim Rokakis says the huge backlog of foreclosure cases causes abandoned homes to sit for many months, attracting crime and driving down the value of neighboring properties.

Rokakis says the program only applies to homes that are tax delinquent, abandoned or vacant.

link to story here [18]

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Is it possible that the former owner of Plymouth Park Tax Services , Jim Florio, had a relative working in the County property tax department?

Unfortunately, in Cuyahoga County anything is possible.

There is an employee in the Cuyahoga County Boards of Revision by the name of Chris Florio. Jim Florio does have a son by the name of Chris Florio.

Chris Florio was apparently up to no good during his employment- which began in 2004 after Florio was appointed to his position by Frank Russo. The same year in which Plymouth Park Tax Services was awarded the no bid contract.

During Chris Florio's employment, the following suspicious transactions occurred:

property assessments to their own members behind closed doors:

• Chris Florio, a board member since 2004, requested a $5,000 decrease on a vacant North Royalton property in 2008. The board decreased the value by $4,900, electronic records show. But paper files for that case have inexplicably disappeared, leaving no way to determine who signed off on the decrease or how quickly the decision was made.Florio's wife, Sharon, requested a $14,200 decrease on a Parma condo on March 2009. After a closed-door deliberation, a board gave her a $14,000 reduction in 37 days, records show.

Florio's son, Christopher, asked for a decrease for a North Royalton home, valued at $187,400 in April 2007. He received a $19,100 reduction within 17 days, records show. Again, the decision was made without a public hearing.

link to Florio story here [19]

Plymouth Park Tax Services, aka Xspand, has had other similar cases in Pennsylvania:

Montco Commish Race Set To Explode

This stems from litigation filed by Municipal Revenue Services against Xspand which, on February 24, 2005, won MontCo’s “no-bid” tax collection contract worth at least $600,000. There was neither prior issuance of a Request for Proposal nor any public bidding or negotiation with competing vendors.

MRS claims Xspand—plus other people and companies—engaged in unfair competition; this includes secret communications between Xspand personnel and these two MontCo commissioners. MRS produces evidence that their leak of private, internal data undermined the public trust, is illegal, and allowed a lucrative contract to be steered to the favored, politically-connected Xspand.

MRS charges the conduct that led to outsourcing the functions of MontCo’s internal Tax Collection Bureau violated the Lanham Act, Sunshine Acts, and the Pennsylvania Public Official and Employee Ethics Act. Essentially, these laws mandate that governmental business be conducted publicly and fairly.

MRS concluded its court filings thusly: “It is highly improper and a violation of the State Ethics Act for any public official to leak confidential information to vendors …about Montgomery County’s strategies” because such pre-meeting disclosure of “non-public, confidential information…violated the public trust and betrayed the public interest.”

The “Pennsylvania Public Official and Employee Ethics Act”prohibits office-holders from gaining personally from their public service. They are prohibited from releasing confidential information, defined as “Information not obtainable from reviewing a public document or from making inquiry to a publicly available source of information.”

Plymouth Park Tax Services is also being investigated for antitrust and collusion regarding the purchase of tax liens in New Jersey.

JPMorgan Unit Subpoenaed in U.S. Investigation of New Jersey Tax-Lien Bids

A JPMorgan Chase & Co. subsidiary is among at least three companies being investigated as part of a U.S. Justice Department antitrust probe of bidding at municipal tax-lien auctions in New Jersey.

story [17]

This link [21]details the nightmare that the political sale of property tax liens has created on numerous counties and how our public officials aggravated the foreclosure crisis.

J P Morgan has recently announced that Plymouth Park Tax Services, aka Xspand, will quit tax lien purchases. story here [22]

JPMorgan Chase has suffered PR headaches in its mortgage servicing business [23] this year. The tax-lien business similarly involves dunning late payers and seizing properties.

"My guess is that there is an image issue," says James Cox, a Duke University School of Law professor who specializes in corporate and securities law. "But I also wonder about the returns. This has not turned out to be a market that produces the returns that they expect to be adequate compensation. … Even investment bankers are worried about their image

link [24]

The Obama administration has recently punished three of the nation's largest banks, including J.P. Morgan, judging them unworthy of receiving financial incentives through its signature foreclosure relief program until they improve their practices.

J. P. Morgan was cut off from receiving it's $6 Million monthly incentive for failure to provide foreclosure relief to the thousands of property owners victimized by J.P. Morgan and it's affiliate, Plymouth Park Tax Services.

Banks that took bailout money were supposed to use part of the taxpayer-provided cash infusion to help customers avoid foreclosure, but instead, many of them are buying up struggling homeowners’ tax debt.

Although the primary goal of the $700 billion bailout was to prop up struggling banks stung by the mortgage crisis, the government has criticized banks that took bailout money for not doing enough to help customers stay in their homes. In June, the U.S. Treasury Department withheld an estimated $24 million in combined monthly incentive payments from three — Bank of America, JPMorgan Chase and Wells Fargo — for not doing enough to help homeowners, and it could do the same for July.

And last month the federal inspector general monitoring the bailout issued a stinging report supporting the penalties.

Schumacher suspects banks really don’t want people to know they are buying tax liens. If customer knew they were buying up tax liens after they took bailout money, banks could suffer a public relations hit, he said.

Banks were involved in creating the mortgage crisis and took the federal government’s money when they hit the wall, Alexander said.

Once they took the public’s money, he said, the banks are in no position to say they no longer have to act in the public interest.

link [26]

*** Update*** J. P Morgan, aka Plymouth Park Tax Services, has admitted their crimhttp://www.lilymiller.us/e of rigging tax lien bids in over 33 states- including Ohio- and have agreed to pay a $211 Million dollar settlement. link to details [28] ***

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

LILY MILLER (216) 386-6546 llymiller [at] yahoo [dot] com http://lilymiller.us/ [29]