Today’s a day Dear in the Heart of Americans.

TAX DAY.

But we all know it is not just a day – not one day taken up with forensic accounting of the last years’ money information. If you file the long form – maybe you have kids, maybe you have more income and expense transactions than would result from having just one annual employer, and maybe you need to itemize your deductions - then in reality one has to take at least 40 hours – ie at least a tax WEEK - to organizing your financial records and enter that information on much-worse-than-cryptic IRS forms.

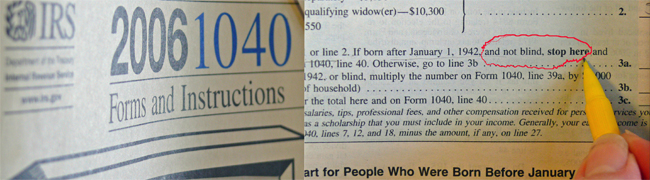

Frankly, the 1040 form is crazy – no exaggeration. The line above with the words “and not blind” captures the desperate Hodge Podge mess of the code – since, if you were blind – the form would have to be in Braille just for the blind preparer to read it. The US tax code is a stale compendium of bizarre special interest legislation. There are exemptions for Cruise Lines (which Aronson owns) , tobacco growers, kids of a certain age at school for certain parts of the year. Some of it makes sense in terms of equitable income scaled taxation – much of it works in just the opposite direction. Every year lobbyists pay the legislature to tweak the code with one liners.

Like Bill Gate’s Microsoft source code, the tax code has become so bloated and cumbersome that it prevents its own healthy upgrading. It has become too big a problem to tackle – so instead the problem just gets bigger and bigger on its own inertia.

You can’t read the tax forms with a straight face. You can’t fill them out in a serious mood. They are so convoluted, so peculiar, so awkward – and yet so serious. No one looks forward to “doing” their taxes. Was that debit purchase from Best Buy last May something for the office or for home? Facing the tax forms is a psychological hurtle and creates a vast negative “externality” to our tax mess. And most significantly, filling out the tax forms sucks up a lot of time.

FLAT TAX WITH NO TAX DAY (WHICH IS ACTUALLY A WEEK) IS MORE EFFICIENT.

Every few presidential cycles there is a candidate – I think Steve Forbes was a recent proponent - who advocates for a version of a flat tax. I support going in the flat tax direction. My argument for support of the flat tax is based on the approximately 2% improvement to the Gross Domestic Product (GDP) output which the flat tax would cause. Here’s how a flat tax would improve the USA’s GDP…

When all of the citizens who earn any money in the US have to stop and take time out of their work to collect records of their income and expenses, this is time that is not productive of any useable product. Though the data collected does have value in finding accounting trends, since most of us don’t use our data for anything other than our tax forms, filling out tax forms is just “busywork”. I know that many, many people spend – or pay someone else to spend – at least 40 hours on their taxes (including time spend during the year collecting and filing receipts, etc.)

With a flat tax none of the busywork would be required. Instead a week of busywork we would have another week annually of productive work. Since individuals in the US work about 50 weeks per year, one more week of work represents about 2% of our annual GDP. Since the GDP of the US increases every year at about 3% a 2% increase on top of the 3% would represent almost a doubling of the US economic growth rate. That’s not China’s growth rate, but 5% is still Huge.

On top of the giant boost in GDP, people would be happier, and improved spirits will impact our national psyche positively, leading to improved health, improved family and business relationships and effectively reducing or eliminating the negative “externalities” of our presently certifiably crazy tax quagmire.

| Attachment | Size |

|---|---|

| IRS-blind.jpg [1] | 142.51 KB |