SearchUser loginTAX LIEN SALES TO PRIVATE COLLECTION BUSINESSESOffice of CitizenRest in Peace,

Who's new

|

Aeon Financial fbo CapitalSource Bank - Property Tax Lien Foreclosure Thieves that do NOT pay their own property taxesSubmitted by Gone Fishin on Thu, 08/04/2011 - 20:28.

STOP THE PROPERTY TAX FORECLOSURE THIEVES

Aeon Financial, LLC, fbo CapitalSource Bank, located in Chicago purchased thousands of delinquent property tax liens from Cuyahoga County and has filed nearly 2,500 property tax foreclosures since 2009.

According to Cuyahoga County's website, Aeon Financial currently owns 243 properties in Cuyahoga County and they are delinquent in paying property taxes for ALL of their properties. This company that foreclosed on property owners for failure to timely pay their property taxes does not pay their own property taxes. Aeon Financial fbo CapitalSource Bank owes Cuyahoga County tens of thousands of dollars in delinquent property taxes, yet the county continues to allow this company to foreclose on property owners for not paying property taxes. According to County records, Aeon Financial owes nearly as much - if not more- than the original property owner owed in delinquent property taxes. Below is a list of all the property owned by Aeon Financial fbo CapitalSource Bank, along with property taxes owed to Cuyahoga County:

1. 10929 Olivet $11,508.32

2. 1256 E. 125 $ 2,260.85

3. 625 E. 118 $ 2,283.57

4. 950 Ida $ 4,110.78

5. 9314 Yale $ 17,694.10

6. 1074 E. 141 $ 1,456.63

7. 1212 E. 71 $ 3,795.16

8. 1254 E. 102 $ 4,698.89

9. 963 E. 129 $ 5,474.44

10. 1128 E. 141 $ 2,380.34

11. 9809 Parmalee $ 1,825.84

12. 10009 Somerset $ 6,040.64

13. 10001 Somerset $ 5,917.20

14. 377 Eddy Rd. $ 9,204.63

15. 144728 Thames $ 3,431.77

16. 2541 Cedar $ 3,111.53

17. 1603 Holyrood $ 5,894.39

18. 449 E. 147 $ 6,920.61

19. 474 E. 125 $ 5,555.67

20. 10704 Kimberley $ 5,506.13

21. 881 Thornhill $ 6,851.06

22. 573 E. 114 $ 5,002.60

23. 12344 Tuscora $ 2,276.88

24. 12428 Tuscora $ 5,550.28

25. 12424 Saywell $ 7,266.20

26. Lot on Shaw Ave. - parcel # 111-11-043 $ 2,092.65

27. Lot on Shaw Ave- parcel # 111-11-044 $ 1,251.95

28. 12408 Saywell $ 2,444.74

29. 508 E. 114 $ 2,904.62

30. 10117 Flora $ 5,342.50

31. 1204 E. 146 $ 2,692.26

32. 11609 Temblett $ 4,173.79

33. Lot on Lisbon - parcel 126-20-047 $ 6,852.63

34. 6629 Charter $ 2,588.32

35. 2009 Hilton $ 6,129.35

36. 17602 St Clair $ 1,598.30

37. 2175 E. 85 $ 8,419.72

38. 2328 E. 88 $ 2,943.24

39. 10707 Crestwood $ 3,783.64

40. 3457 E. 69 $ 2,198.39

41. 2346 E. 61 $ 1,1154.23

42. 832 E. 154 $ 22,407.06

43. 16437 Braddock $ 3,294.77

44. 1121 Galewood $ 1,775.52

45. 10006 Quebec $ 925.10

46. 3283 E. 103 $ 2,084.64

47. 15609 School $ 3,667.84

48. 2853. E 98 $ 2,858.45

49. 3290 Regent $ 1,560.82

50. 2865 E. 92 $ 940.52

51. 1378 Larchmont $ 4,714.48

52. 1447 E. 162 $ 2,597.65

53. 1443 Lakeview $ 1,561.83

54. 1946 Westburn $ 2,902.79

55. 2185 E. 106 $ ,941.30

56. 5666 Hamlet $ 1,733.07

57. 2620 E. 89 $ 7,118.03

58. 3658 E. 108 $ ,882.61

59. 9416 Manor $ 2,339.26

60. 9516 Hilgert $ 3,185.66

61. 9604 Sophia $ 2,684.87

62. 9323 Mt. Auburn $ 1,081.07

63. 7211 Indiana $ 3,207.47

64. 7203 Indiana $ 1,302.04

65. 4104 E. 79 $ 1,421.11

66. 11804 Dove $ 1, 211.30

67. 15021 Edgewood $ 1,109.90

68. 11726 Parkview $, 2, 308.55

69. 3629 E. 123 $ 11, 413.53

70. 6404 Fullerton $ 165.46

71. 3660 E. 106 $ 769.44

72. 9819 Stoughton $ 2,204.39

73. 3818 E 54 $ 1,036.00

74. 4096 E 57 $ 1,414.37

75. 10002 Stoughton $ 1,113.22

76. 12408 Farringdon $ 248.72

77. 3763 E 126 $ 830.20

78. 3680 E 133 $ 762.04

79. 3933 E 66 $ 3,765.48

80. 6826 Krakow $ 2,416.55

81. 2814 E 127 $ 3,268.41

82. 6622 Fullerton $ 7,005.50

83. 13002 Benham $ 186.74

84. 3753 E. 93 $ 4,500.35

85. 3239 E 117 $ 1,540.88

86. 3828 E 140 $ 1,376.94

87. 4129 E 110 $ 2,701.08

88. 3669 E 52 $ 701.84

89. 10902 Gay $ 1,474.08

90. 3461 E 143 $ 1,290.16

91. 7803 Connecitut $ 1071.26

92. 4267 E 114 $ ,149.92

93. 3675 E 139 $ 835.70

94. 2993 E 128 $ 964.00

95. 8607 Grand Division $ 2,303.04

96. 3672 E 54 $ 2,530.69

97. 16401 Judson $ 1,419.76

98. 17214 Lotus $ 2,946.38

99. 3943 Strandhill $ 1,632.94

100. 4811 E 176 $ 1,516.94

101. 4266 E 160 $ 2,932.00

102. 3104 Russell $ 1,632.17

103. 4991 E. 90 $ 3,352.45

104. 325 E 215 $ 2,207.06

105. 1444 Sulzer $ 4,975.69

106. 19071 Pasnow $ 1,579.27

107. 851 Nelaview $ 17,564.49

108. 2268 Taylor $ 10,603.20

109. 1300 E 143 $ 3,507.89

110. 1346 E 141 $ 2,601.49

111. 1466 E 134 $ 3,242.01

112. 14212 Savannah $ 2,101.17

113. 13313 Gainsboro $ 3,258.37

114. 1176 Bender $ 2,360.17

115. 3197 East Berkshire $ 2,688.04

116. 15345 Plymouth $ 2,970.46

117. 3254 East Berkshire $ 6,860.73

118. 1520 E. 133 $ 1,953.65

119. 1536 Lakefront $ 1,222.80

120. 13818 Woodworth $ 3,068.77

121. 1732 Shaw $ 3,020.61

122. 13701 Graham $ 1,929.68

123. 1355 Dill $ 14,440.65

124. 3709 Sudberry $ 2,164.62

125. 19300 Fairway $ 3,559.62

126. 18975 Van Aken $ 2,333.93

127. 15675 Friend $ 3,169.92

128. 5144 Theodore $ 5,339.30

129. 5178 Theodore $ 12,798.08

130. 20715 East Ridgewood $ 2,215.08

131. 22741 Libby $ 2,117.84

132. 15316 Northwood $ 4,906.42

133. 19707 Kings Highway $ 7.082.82

134. 17109 Mapleboro $ 2,441.02

135. 21504 Franklin Rd. $ 3,462.24

136. 19302 Shakerwood $ 3,675.84

137. 23823 Banbury $ 2,108.58

138. 19611 Longbrook $ 1,529.60

139. 4490 Granada $ 4,792.20

140. 3643 Rolliston $ 13,984.08

141. 21009 Hillgrove $ 12,218.75

142. 00023 Whitaker $ 3,282.36

143. 8010 Bellevue $ 1,623.28

144. 2346 E 61 $ 1,1162.47

145. 3772 E 144 $ 1,391.60

146. 4230 E 98 $ 4,395.75

147. 3741 E 143 $ 2,690.60

148. 4155 E 141 $ 974.68

149. 4161 E 189 $ 1,073.68

150. 4185 Lee $ 2,773.88

151. 4658 E 157 $ 1,179.61

152. 17116 Judson $ 1,171.10

153. 4839 E 86 $ 11,650.61

154. 12813 North Parkway $ 4,751.08

155. 4949 E 141 $ 5,234.68

156. 11215 Plymouth $ 3,557.42

157. 13118 Forestdale $ 6,595.92

158. 4705 E 93 $ 2,554.40

159. 12809 Rexwood $ 5,092.39

160. 20271 Priday $ 1,571.94

161. 316 E 260 $ 5,385.39

162. 1507 E 256 $ 1,932.77

163. 20060 Champ $ 5,237.92

164. 1464 E 250 $ 3,349.99

165. 1277 Hayden $ 4,841.88

166. 1245 Rozelle $ 2,272.17

167. 14631 Savannah $ 3,258.21

168. 14317 Terrace $ 4,685.80

169. 13915 Scioto $ 3,071.37

170. 12824 Speedway Overlook $ 3,088.80

171. 1627 Eddy $ 1,682.69

172. 14004 Ardenall $ 2,135.39

173. 13909 Potomac $ 1,997.28

174. 1888 Wymore $ 2,561.83

175. 14208 Potomoc $ 2,681.33

176. 1730 Allandale $ 2,243.45

177. 1768 Coit $ 1,048.05

178. 1780 Delmont $ 33,482.90

179. 19505 Kings Highway $ 1,812.64

180. 10510 Madison $ 1,606.24

181. 5916-18 Madison $ 16,159.99

182. 6004 Madison $ 5,573.04

183. 2128 W 105 $ 3,441.42

184. 6808 Lorain $ 1,692.04

185. 3082 W 110 $ 4,475.88

186. 2092 W 87 $ 4,032.15

187. 2061 W 95 $ 3,180.26

188. 7315 Lawn $ 853.96

189. 3628 Hyde $ 4,980.90

190. 3431 W 62 $ 820.16

191. 3062 Sackett $ 3,211.07

192. 3721 W 39 $ 1,019.44

193. 7503 Dearborn $ 4,015.15

194. 3541 Trowbridge $ 556.36

195. 3115 W 88 $ 1,444.70

196. 3219 W 88 $ 3,133.68

197. 3807 Robert $ 1,409.30

198. 3122 W 52 $ 1,079.36

199. 3403 W 58 $ 3,045.71

200. 3159 W 94 $ 968.52

201. 3189 W 86 $ 3,078.57

202. 4510 Bush $ 3,635.48

203. 3413 W 90 $ 1,650.76

204. 3432 W 91 $ 1,126.80

205. 12809 Guardian $ 6,331.86

206. 4068 E 57 $ 2,671.43

207. 13015 Lorenzo $ 1,126.80

208. 16417 Westview $ 3,208.42

209. 1524 E 195 $ 1,311.00

210. 1028 E 169 $ 5,024.21

211. 21019 Kenyon $ 2,016.60

212. 2069 W 83 $ 2,445.45

213. 3847 w 136 $2,143.08

214. 19610 Meadowlark $ 2,073.58

215. 4416 Parkton $ 6,592.70

216. 23412 Kirkland $ 1,381.94

217. 4510 Storer $ 2,362.13

218. 3639 Randolph $ 9,636.44

219. 1028 E 169 $ 5,204.21

220. 21019 Kenyon $ 2,016.60

221. 7207 Duluth $3,285.61

222. 1200 E. 61 $ 1,143.68

223. 3339 W. 94 $ 3,230.17

224. 2128 W. 105 $ 3,441.42

225. 10329 Yale $ 4,288.48

226. 902 Herrick $ 2,297.13

227. 1242 E. 100 $ 1,877.17

228. 10835 Hampden $ 556.36

229. 11209 Whitmore $ 3,925.70

230. 869 E. 140 $ 6,665.49

231. 1357 E. 170 $1,178.30

232. 5611 Outhwaite $ 1,226.24

233. 2865 E. 92 $ 940.52

234. 4068 E. 57 $ 2,671.43

235. 3675 E 139 $ 835.70

236. 19071 Pasnow $ 1,599.27

237. 1464 E 250 $ 3,349.99

238. 952 Wheelock $ 3,128.84

239. 661 E. 94 $ 1,634.66

240. 10009 Ostend $ 1,008.46

241. 13904 Darley $ 837.06

242. 11418 Notre Dame $ 2,000.56

243. 8614 Capital $ 1,742.84

Our county officials are incompetent.

They allow this tax lien company to foreclose upon others for delinquent property taxes, yet this scum company does NOT pay their property taxes after they receive ownership via tax foreclosures.

Aeon Financial also does not maintain their property and taxpayers are forced to foot the bill for grass cutting, board-up fees, and demolitions.

We are forced to look to nearly 300 vacant and vandalized properties which are in the ownership of Aeon Financial after property owners were forced out of their homes for petty delinquent property taxes. Many of the former property owners owned their houses for decades.

Aeon Financial also refuses to pay for demolitions on property in which Aeon Financial has literally left to rot and destroy our neighborhoods.

Pure genius elected officials that continue to allow this to happen.

There is also very odd tax issues with several of their properties as detailed below. The County Auditor's office shows property taxes due for the 2009 pay in 2010 tax years; however, the records for the 2010 pay in 2011 taxes year reflect a zero balance due, although no payment of taxes is shown in the county records. It appears the taxes were wiped off the books. The county's solution is to collect delinquent property taxes in a lump sum for one year, and then simply wipe out and reduce to $0 the remainder of the owed property taxes. This ain't high math here. There is a huge loss of property taxes when the tax investor forecloses on property.

WOODS, JOEL WAYNE SR recently purchased the property, parcel # 113-29-011, address 17905 DELAVAN RD. $15,044 sale price $74,600 value assessed value $ 26,120.00 $0.00 taxes owed for 2010-11 $3,534.84 previous taxes for 2009 pay in 2010 appear to be wiped out.

644-12-027 25251 Shoreview AVE, Euclid, OH 44132 $0.00 taxes owed 2010 pay 2011 2,567.49 owed 2009 pay 2010 no payment shown on Auditor's website 18-FEB-11 transfer date

119-29-067 2175 E 85 ST, Cleveland, OH 44106 $0.00 taxes owed 2010 pay 2011 $1,616.54 owed 2009 pay 2010 no payment shown on Auditor's website 18-FEB-11 transfer date

121-20-079 02185 E 106 ST $0.00 taxes owed 2010 pay in 2011 $600.98 owed in 2009 pay in 2010 no payment shown on Auditor's website 18-FEB-11 transfer date

131-35-112 3672 E 54 ST, Cleveland, OH 44105 $0.00 taxes owed 2010 pay in 2011 $2,256.62 owed in 2009 pay in 2010 no payment shown on Auditor's website 18-FEB-11 transfer date

If the goal of Cuyahoga County is to collect property taxes and the county believes that selling delinquent tax liens is the solution, what happens when the tax lien company that now owns 243 properties obtained via tax foreclosures fails to pay their own property taxes? NOTHING

Cuyahoga County has recently convicted a couple of housing con artists here on a felony level for engaging in nearly the exact same circumstances as Aeon Financial and the con artists were sent to prison, fined, and forfeited all of their property; however no felony cases have been filed against Aeon Finanicial's group of con artists. The other con artists were also hit hard with housing code violations, fines, and the threat of jail time from Cleveland Housing Court; however Aeon has very few cases filed in Cleveland Housing Court although most of their properties have been left to rot with no simple maintenance. It appears Aeon Financial is receiving special treatment from county and city officials.

The photos below are just a sample of Aeon Financial's destruction. Doors and windows are wide open on many properties owned by Aeon Financial:

Aeon Financial recently sold approximately 100 properties to a shell LLC - BINARKO PROPERTIES LLC. I believe the shell LLC is meant to hide Aeon Financial's property and is also an attempt to avoid any demolition cost for some of the dumps they have allowed to be vandalized and left to rot. Cleveland Housing Court attempted to serve Binarko Properties LLC summons' for seven cases recently filed in court for failure to furnish certificates of disclosure. Every single violation notice was returned to the court for lack of service. The reason, " Moved- left no address". So now the court is left with no way of serving the summons' to the shell LLC.

2013 CRB 033109 STATE OF OHIO / CITY OF CLEVELAND -VS- BINARKO PROPERTIES LLC

Although Aeon alleges that they sold the nearly 100 properties to Binarko Properties LLC, it is odd that Aeon Financial's attorney prepared the deeds for property in which Binarko turned around and sold for pennies on the dollar. It is also highly suspicious for Binarko Properties LLC to pay way more for the property than the asking price by a local Realtor just prior to the alleged sale, and Binarko purchased in bulk. Common sense would tell you that purchasing in bulk would lower the cost of the property- not multiply the cost. The nearly 100 properties allegedly purchased by Binarko Properties all had mortgages payable to Aeon Financial. Binarko paid more than the requested selling price and turned around and sold several properties for far less than they allegedly paid just weeks prior- with no mortgage releases filed AND no delinquent property taxes paid.

Cuyahoga County sold tax liens to Woods Cove in 2011 and again in 2013. One of the investors for Woods Cove, David Schwartz, is the COUSIN of Mark Alan Schwartz- the main player behind Aeon Financial. Cuyahoga County property owners are in for one hell of a ride as vulture capitalism is a Schwartz family affair.

It is most unfortunate that city and county officials look the other way and fail to address the serious issue of their constitutients being ripped off by tax lien investors who fail to pay their own property taxes and fail to provide simple maintenance on their properties. The county/city officials - who are elected by the people to represent the people - have failed miserably. County officials are more interested in receiving the millions of dollars from the tax lien purchases, but they fail to address the millions of tax dollars lost in the process. Our state recently received millions of dollars meant to benefit foreclosure victims; however county officials have decided to raid this fund and spend millions to demolish properties- including demolishing the property owned by tax lien investors. The state foreclosure funds could and should be used more wisely and for their intended purpose- to help the victims. A portion of this fund should be given to victims of the property tax lien scam. County officials need to step up to the plate and quit allowing tax lien investors to destroy lives and neighborhoods. Officials blame everyone but themselves for the crisis that they have created. Tax Lien reform is desperately needed in this county and across the country. Thousands of victims were sold out by their own county officials to predatory tax collectors. Tax Lien investors should NEVER be tax delinquent on any property taken by others for tax delinquency. A simple clause in the county's contract specifying that NO active foreclosures will proceed in court, NO new foreclosures can be filed, NO property obtained via tax delinquent foreclosures will transfer, and NO property owned by the lien investor can be sold if the investor owes any delinquent property taxes will solve one of the many problems.

Aeon Financial Tax Lien Services is NOT the only tax lien purchaser who failed to timely pay property taxes on property they obtained via delinquent property tax lien foreclosures in Cuyahoga County. Plymouth Park Tax Services purchased tax liens in Cuyahoga County in 2008, and they also failed to pay their OWN delinquent property taxes on property which was foreclosed upon for delinquent property taxes. The tax lien thieves have developed a pattern and practice of failing to pay their own delinquent property taxes, and not a single word mumbled by county or city officials.

READ here for more info on PLYMOUTH PARK TAX SERVICES http://realneo.us/content/plymouth-park-tax-services-aka-xspand-cuyahoga-county-victims-corruption-deserve-justice

Thousands of lives have been disrupted, family homes stolen , neighborhoods destroyed, along with increased homelessness over petty delinquent property taxes. People who have made the mistake by living and investing in Cuyahoga County - FOR DECADES - should not be kicked to the curb over petty delinquent property taxes. Meanwhile, the politically connected, investors hiding property behind shell LLC's , friends and family of the politically connected, and the tax lien investors themselves get a free ride on their delinquent property taxes. The tax lien sale process is flawed with no certain method as to picking and choosing who gets sold out to the predators. Tax liens sold for petty amounts for some victims, yet others can owe mulitiple times the amount of other victims and face no consequence. Some property owners have failed to pay property taxes for years and now owe nearly as much as the value of the property - with no tax lien ever sold and no tax foreclosure ever filed by the county. Our local media has ignored this serious issue and refuses to report on the flawed tax lien process. I have contacted our local media and they do not return phone calls or respond to emails. I suppose they want to hide the facts. I imagine that the victims - who have lost their HOMES- will be highly pissed off to learn that the tax lien investors do not pay their own delinquent property taxes on property they obtained via delinquent property tax lien foreclosures.

The people in our county are in serious trouble with incompetent and corrupt public officials. Please read more of my blogs here http://realneo.us/blogs/lmiller and send in the National Guard to help us. SOS

*** UPDATE*** See The Washington Post expose here http://www.washingtonpost.com/sf/investigative/2013/12/08/debt-collecting-machine/?hpid=z2

Lily (216) 386-6546

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

( categories: )

|

Recent commentsPopular contentToday's:

All time:Last viewed:

|

Looks like a repeat of Plymouth Park Tax Services

COUNTY STEALS PROPERTY FROM STUNNED GRANDSON

By Dr. Laurie Roth

June 24, 2011

NewsWithViews.com

In part,,,,,

On December 7, 2010, Malik J. Tuma, attorney of record for Capitol source/fbo Aeon/tax lien law group, (now under investigation and lawsuit by Peter Nickels, Attorney General for the District of Columbia) filed a complaint to foreclose on Jeffrey’s right to redeem his property, even though his property had already been redeemed and revalidated as declared in the receipt issued by Baltimore County.

In talking further with Jeffrey about the actions of Aeon Financial to foreclose and sell off his property in a tax sale, a sinister thought came to my mind. Are we looking at the potential of organized crime here, where payments and agreements are ignored, homes and properties seized, then resold. The record shows in 2010 that Aeon Financial sold 8500 homes in tax sales. How many of these people had made payments and signed contracts that had been ignored, manipulated or refunded??? That is called stealing in my book.

link

Two demolished properties

I drove by two properties that are owned by this company and both houses have been demolished.

This company owes Cuyahoga County over $10,000 for property taxes and demolition fees associated with both properties.

Who is going to end up paying the $10,000 bill? Cuyahoga County taxpayers after Aeon Financial, aka CapitalSource Bank 'donates' this property to the County Landbank.

Aeon Tax Lien Thieves

Aeon forecloses on others for delinquent property taxes and then fails to pay their OWN property taxes.

Scum Thieves:

PARCEL ID 002-28-080

OWNERS NAME AEON FINANCIAL LLC

ADDRESS 05916/18 MADISON AVE

CITY CLEVELAND

Transfer Date: 02-JUN-11

Prior year August interest - 2012

PAYMENTS $ 0.00

---------------------------------------------

Transfer Date: 18-FEB-11

PARCEL ID 105-23-050

OWNERS NAME AEON FINANCIAL LLC

ADDRESS 01212 E 71 ST

CITY CLEVELAND

Prior year August interest - 2012

Prior year penalty - 2011

PAYMENTS $ 0.00

-----------------------------------------

The list could go on and on.

The scum thieves now own 225 properties in Cuyahoga County.

They are NOT maintaining their property and NOT paying taxes.

Long time property owners lost their homes via delinquent property tax liens. This scam tax lien company takes property from others for delinquent property taxes and then fails to pay their own.

Cuyahoga County officials fail to address this issue with Aeon and Plymouth Park Tax Services.

Cuyahoga County officials are too busy plotting their next tax lien sale - scheduled for tomorrow- May 31, 2013.

County officials look the other way while the tax lien companies add fuel to the foreclosure crisis and FAIL TO PAY THEIR OWN PROPERTY TAXES.

Aeon foreclosed on an additional 39 properties thus far in 2013. Aeon should NOT be able to legally proceed with foreclosures when they are tax delinquent themselves.

I predict - in the very near future - that Aeon will 'donate' most of their property to the Cuyahoga County Land Bank. Tax payers will foot the bill for the lost property taxes, maintenance of the property and lots of demolitions.

And the County's Con Artist will have the ability to give the property to out of state investors. http://realneo.us/content/gus-frangos-president-cuyahoga-county-land-ban...

Most of the property owned by Aeon is vacant and more than likely vandalized. Aeon continues to foreclose on hold the deeds for the property as they use the property as their 'portfolio' to borrow money from investors. The investors are unaware of the condition of the property and investment money continues to flow.

THIEVES.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Our local Government ALLOWS this to DECONSTRUCT & earn $

Okay...what's the bottom line for leadership? THEIR PAYCHECK.

How do they get that paycheck? Taxing, Fining, and Selling us out.

All these criminal business ventures that our leadership enters into are designed to inflate their paychecks....it's flat out fraud.

They allow foreclosures back to banks and tax certificate buyers who are NOT LOCATED LOCALLY...Then they CONTRACT SUBCONTRACTOR LABORERS TO ALLEGEDLY MAINTAIN THE VACANT PROPERTIES....none of it works, it all leads to vandalism, destruction, and supporting the ultimate MASTER PLANS AT THE CITY OF CLEVELAND PLANNING COMMISSION....

Oh boy...and then the FEDERAL TAX DOLLARS WE GET FOR ALL THESE QUOTAS of vacant houses...that pays the philanthropic community development workers to go around gentrifying the hood.

PLANNED OBSOLESCENCE! Designed to break down. WASTEFUL SPENDING BY THE GOVERNMENT...

You don't think that they'd help the people to stabilize homes in default and their families? DO you? lol.....it's all a big fraud upon the TAXPAYERS.....

the grand SOCIAL EXPERIMENT: SEE HERE:

http://www.huduser.org/portal/periodicals/em/spring13/highlight2.html

Always Appreciative,

"ANGELnWard14"

Aeon Financial fbo CapitalSource Bank is up to NO good AGAIN

The tax lien thieves are up to NO good AGAIN

Cuyahoga County officials sure did one hell of a job bringing these tax lien thieves into our county.

Aeon Financial recently sold five properties to IR Home Fund LLC:

1. 12809 Rexwood Avenue, Garfield Hts., OH. On May 24, 2013, Aeon sold the property for $1,350. This property transferred to Aeon CapitalSource on 12/16/11 and NO taxes have been paid since the 2011 transfer - taxes owed and NOT paid despite the recent sale $2,324.83. The former owners owned this property since 1987 prior to being sold out by incompetent county officials.

2. 1447 East 162nd Street, Cleveland, OH. On May 24, 2013, Aeon sold the property for $100. This property transferred to Aeon CapitalSource on 12/16/11 and NO TAXES have been paid since the 2011 transfer - taxes owed and NOT paid despite the recent sale $ 1432.36. The former owners owned this property since 2007 prior to being sold out by incompetent county officials.

3. Empty lot on Shaw Avenue, parcel # 111 11 044. On May 24, 2013, Aeon sold the property for $100. This property transferred to Aeon CapitolSource on July 14, 2011 and NO TAXES have been paid since the 2011 transfer- taxes owed and NOT paid despite the recent sale $ 404.33. This property has transferred back and forth from NorthEastern Neighborhood Development and the County Land Bank prior to transferring to Aeon thieves.

4. Empty lot on Shaw Avenue, parcel # 111 11 043. On May 24, 2013, Aeon sold the property for $100. This property transferred to Aeon CapitalSource on July 14, 2011 and NO TAXES have been paid since the 2011 transfer- taxes owed and not paid despite the sale $1064.95. This property has transferred back and forth from NorthEastern Neighborhood Development and the County Land Bank prior to transferring to Aeon thieves.

5. 10117 Flora Avenue, Cleveland, OH. On May 24, 2013, Aeon sold the property for $ 1200. This property transferred to Aeon CapitalSource on 12/16/11 and NO TAXES have been paid since the 2011 transfer - taxes owed and not paid despite the sale $ 1071.24. The former owners owned this property since 2007 prior to being sold out by incompetent county officials.

All five properties were purchase by IR Home Fund LLC. The Ohio Secretary of State has no record of this LLC ever being filed:

IR Home Fund LLC uses 11470 Euclid Avenue, Cleveland, Ohio as their tax mailing address:

CLEVELAND, OH 44106

(216)421-7200

Monday: 8:30 AM-7:00 PM Tuesday: 8:30 AM-7:00 PM Wednesday: 8:30 AM-7:00 PM Thursday: 8:30 AM-7:00 PM Friday: 8:30 AM-7:00 PM Saturday: 10:00 AM-4:00 PM

And Cuyahoga County taxpayers have been RIPPED OFF again.

The exact same county officials that receive six figure salaries to save us from the foreclosure crisis created this crisis.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

IR Home Fund LLC - Florida based LLC - not registered in Ohio

IR Home Fund LLC is located in Florida, NOT registered in Ohio despite operating in Ohio, and uses Cleveland UPS as it's mailing address for property tax purposes.

8345 Nw 66th St

Miami, Florida 33166-2626

United States

http://companies.findthecompany.com/l/30779602/Ir-Home-Fund-Llc-in-Miami-FL

The Miami Florida address is also a UPS store:

MIAMI FL 33166

8345 NW 66TH ST

MIAMI FL 33166

Restricted delivery means that the sender's mail is delivered only to a specific person or to someone authorized in writing to receive mail for the addressee.

If you write ''Yes'' we will be authorized to accept mail sent to you using ''Restricted Delivery'' service.

If you write ''No'' we will not be able to receive this type of mail for you.

http://www.usabox.com/instructions1583.asp

I did not find IR Home Fund LLC registration with Florida's Secretary of State either.

IR Home Fund LLC also owns the following property not obtained by Aeon Financial THIEVES:

1. 14219 Westropp , Cleveland, OH - State of Ohio forfeiture case

2. 991 East 130th Street, Cleveland, OH - State of Ohio forfeiture case

3. 14302 Westropp, Cleveland, OH - purchase price $2500

4. 2143 West 83rd Street, Cleveland, OH - purchase price $ 1000

5. 11413 Notre Dame, Cleveland, OH - purchased for $1000 on 2/5/13 - sold to Investor's Resource Inc on 4/16/13 for $10,000 - sold to CRTN INTERNATIONAL for $ 22,650 on 4/16/13.

Flippers from Florida.

Investor's Resource Inc., is also NOT registered in Ohio despite doing business in Ohio.

CRTN International is also NOT registered in Ohio despite doing business in Ohio.

IR Home Fund is selling , aka flipping, all of their property to Investor's Resource ( which I believe are the same companies ) who in return flips the property to CRTN International :

CRTN International is located in Detroit Michigan:

I did not find CRTN International LLC registered with Michigan Secretary of State business filings either.

Selling delinquent property tax liens greatly contributes to the foreclosure crisis as research has proven time and time again.

I have been waiting for Cuyahoga County to release the new purchasers of the May 21, 2013 tax lien sale, but the county has not yet released this information publicly.

Every single tax lien purchaser that Cuyahoga County has dragged into this county has ripped off county taxpayers and destroyed this county. After the tax lien company forecloses on others for delinquent property taxes, the thieves do NOT pay their own property taxes.

County officials look the other way each and every time. The so called media NEVER reports on this issue. I have contacted all of the local media numerous times.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Aeon Financial transferring lots of property to Binarko Property

Aeon Financial Tax Lien Thieves are transferring several of their properties to a shell agent / incorporator - Delaware based BINARKO PROPERTIES LLC.

1300 EAST NINTH STREET

CLEVELAND,OH 44114

Effective Date: 01/11/2013

Contact Status: Active

Aeon Financial failed to pay their OWN delinquent property taxes for all of the property that was recently transferred.

Most of the property sold for a couple thousand dollars or less.

Imagine being sold out by incompetent county officials for petty delinquent property taxes, and later the property owners find out that the tax lien thieves themselves owed more in delinquent property taxes than the owners who were foreclosed upon.

And county officials did NOTHING while Aeon Financial destroyed neighborhoods and failed to pay their OWN property taxes.

Aeon reduced the value of nearly 300 properties to an average of a couple thousand dollars each. Many properties were owned for decades.

The following is a list of property, along with Aeon's OWN delinquent property taxes, that recently transferred from Aeon Financial to Binarko Properties:

110-23-054 BINARKO PROPERITES LLC (OH) SERIES - 25 12428 TUSCORA CLEVELAND

110-24-005 BINARKO PROPERITES LLC (OH) SERIES - 26 12424 SAYWELL CLEVELAND

110-29-034 BINARKO PROPERITES LLC (OH) SERIES - 27 01256 E 125 CLEVELAND

111-01-030 BINARKO PROPERITES LLC (OH) SERIES - 28 00573 E 114 CLEVELAND

111-10-027 BINARKO PROPERITES LLC (OH) SERIES - 29 00474 E 125 CLEVELAND

111-25-090 BINARKO PROPERITES LLC (OH) SERIES - 31 01128 E 141 CLEVELAND

115-22-047 BINARKO PROPERITES LLC (OH) SERIES - 32 00832 E 154 CLEVELAND

115-24-018 BINARKO PROPERITES LLC (OH) SERIES - 33 15609 SCHOOL CLEVELAND

116-29-149 BINARKO PROPERITES LLC (OH) SERIES - 34 01378 LARCHMONT CLEVELAND

119-29-067 BINARKO PROPERITES LLC (OH) SERIES - 35 02175 E 85 CLEVELAND

120-13-015 BINARKO PROPERITES LLC (OH) SERIES - 36 01443 LAKEVIEW CLEVELAND

125-26-132 BINARKO PROPERITES LLC (OH) SERIES - 38 05666 HAMLET CLEVELAND

125-32-067 BINARKO PROPERITES LLC (OH) SERIES - 39 06629 CHARTER CLEVELAND

126-13-012 BINARKO PROPERITES LLC (OH) SERIES - 40 02620 E 89 CLEVELAND

126-36-008 BINARKO PROPERITES LLC (OH) SERIES - 41 02865 E 92 CLEVELAND

128-02-040 BINARKO PROPERITES LLC (OH) SERIES - 42 10707 CRESTWOOD CLEVELAND

128-10-032 BINARKO PROPERITES LLC (OH) SERIES - 43 02853 E 98 CLEVELAND

128-13-040 BINARKO PROPERITES LLC (OH) SERIES - 45 09819 STOUGHTON CLEVELAND

128-16-076 BINARKO PROPERITES LLC (OH) SERIES - 47 09323 MT AUBURN CLEVELAND

128-20-050 BINARKO PROPERITES LLC (OH) SERIES - 48 09516 HILGERT CLEVELAND

129-16-046 BINARKO PROPERITES LLC (OH) SERIES - 49 02814 E 127 CLEVELAND

130-01-051 BINARKO PROPERITES LLC (OH) SERIES - 50 03239 E 117 CLEVELAND

130-03-044 BINARKO PROPERITES LLC (OH) SERIES - 51 03269 E 123 CLEVELAND

132-14-050 BINARKO PROPERITES LLC (OH) SERIES - 53 06622 FULLERTON CLEVELAND

135-09-001 BINARKO PROPERITES LLC (OH) SERIES - 56 03658 E 108 CLEVELAND

136-22-051 BINARKO PROPERITES LLC (OH) SERIES - 59 04230 E 98 CLEVELAND

110-24-009 BINARKO PROPERTIES LLC (OH) SERIES 12408 SAYWELL CLEVELAND

105-23-050 BINARKO PROPERTIES LLC (OH) SERIES - 10 01212 E 71 CLEVELAND

125-10-002 BINARKO PROPERTIES LLC (OH) SERIES - 102 03115 E 65 CLEVELAND

125-30-044 BINARKO PROPERTIES LLC (OH) SERIES - 103 03290 REGENT CLEVELAND

108-04-045 BINARKO PROPERTIES LLC (OH) SERIES - 88 00661 E 94 CLEVELAND

109-04-111 BINARKO PROPERTIES LLC (OH) SERIES - 90 10322 ADAMS CLEVELAND

110-04-013 BINARKO PROPERTIES LLC (OH) SERIES - 91 00625 E 118 CLEVELAND

111-15-042 BINARKO PROPERTIES LLC (OH) SERIES - 95 00414 E 124 CLEVELAND

111-28-044 BINARKO PROPERTIES LLC (OH) SERIES - 96 01204 E 146 CLEVELAND

116-20-096 BINARKO PROPERTIES LLC (OH) SERIES - 98 16437 BRADDOCK CLEVELAND

I drove by several of these properties many months ago. Most are now reduced to dumps that will require demolition.

Photos of some of the property below and MORE here http://realneo.us/content/property-owned-capitalsource-fbo-aeon-financial-and-list-code-violations-will-be-reported

6808 Lorain.

Holes in roof, walls, ceilings and floors. Rotten wood throughout. Missing gutters, missing siding, MISSING EVERYTHING.

On August 12, 2013, the above property sold for $ 5,431. Delinquent property taxes unpaid $ 1954.30.

This sale is a scam. I've been watching this particular property and the realtor had this property listed for months with a list price of less than $1000- and the property recently sold for over 5 times the amount that the realtor requested.

The attorney for Aeon Financial said this property was a " complete and total rehab." He also said, " I received conflicting information regarding condemnation / demolition status and the sale is buyer beware."

Aeon is flipping property to out-of-state flippers, NOT paying their own taxes, and they are selling condemned property that requires demolition.

Fine batch of thieves Cuyahoga County officials dragged into our county.

Below is the realtor information that had this property listed for $999:

http://www.realtytrac.com/property/oh/cleveland/44102/6808-lorain-ave/140954882

3628 Hyde Avenue, Cleveland, Ohio:

Cleveland, OH 44109

View on Map »

Who will pay for the demolitions and lost property taxes for all of these properties and several more still owned by Aeon Financial Tax Lien Thieves? TAXPAYERS

Does selling delinquent property tax liens really make any sense? Every tax lien purchaser our incompetent county officals deal with all do the same thing.

They don't pay their own property taxes on property which was foreclosed upon for delinquent property taxes, and they leave behind vandalized property that blights neighborhoods.

It will be interesting when Woods Cove Tax Lien company pulls the exact scam.

Woods Cove Tax Liens was the most recent purchaser of tax liens in Cuyahoga County (2011), and they have already filed 1302 tax foreclosures.

Both AEON FINANCIAL & WOODS COVE TAX LIENS are connected as they involve relatives - cousins.

***** I was told by a very reliable source (and have the documentation to prove the allegation ) that they are one of the same ******

Aeon Financial received three mortgages from Capital Source Bank- up to 30 MILLION DOLLARS - and put up worthless property in Cuyahoga County as collateral.

The exact same property they are now selling for a couple thousand dollars was used as collateral for the 30 MILLION loan.

I believe the additional collateral money Aeon Financial received from Capital Source Bank was used to fund the purchase of tax liens under the guise of Woods Cove Tax Liens.

I believe the deal with Aeon Financial and Woods Cove Tax Liens is collusion considering the main forces behind the scenes of BOTH companies are relatives (cousins) , and I also believe the 30 Million collateral loan for dump properties that Aeon Financial received was used to fund Woods Cove Tax Liens.

And more connections here:

http://realneo.us/content/woods-cove-tax-liens-predators

Collusion is common with tax lien companies:

http://www.njspotlight.com/stories/13/01/09/fbi-probe-snares-another-firm-for-rigging-tax-lien-auctions/

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Aeon Financial - Binarko Properties - Reovest

Binarko Properties is buying bulk cheap real estate from Aeon Financial and others.

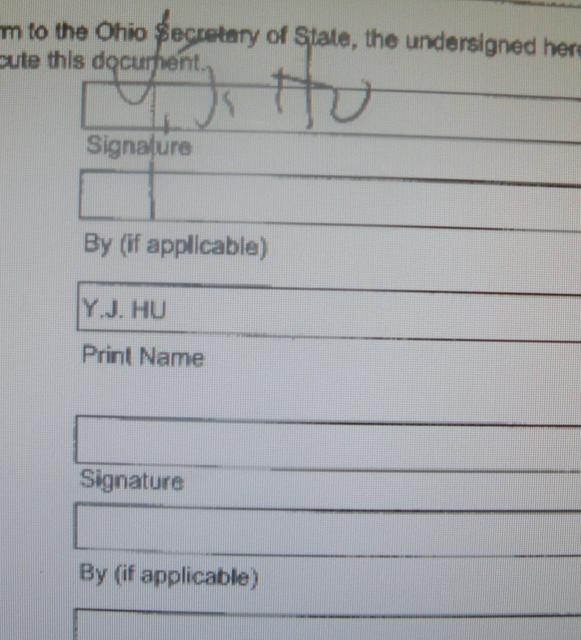

The main person behind Binarko Properties is Y J HU.

Binarko Properties uses the address of 1825 Ponce de Leon Blvd., Coral Gables, Florida.

This address is a mail drop off box located at UPS:

1825 PONCE DE LEON BLVD

CORAL GABLES, FL 33134

http://www.theupsstorelocal.com/1653/about-our-store/map--directions/map--directions

Binarko Properties parent company, REOVEST, purchases cheap real estate in bulk and flips the property.

ALL OF OUR LISTINGS ARE CURRENT AND ARE LISTED FOR IMMEDIATE SALE.

SELLER FINANCING IS AVAILABLE

http://www.reo-vest.com/about-me/

It is amazing that millions of dollars are being wasted at the Cuyahoga County Land Bank to protect property from risky, out-of-state investor flippers.

Cuyahoga County officials are directly responsible for the self-destruction of our county since the county sold tax liens to these thieves in the first place.

Long term property owners were forced out of their homes for petty delinquent property taxes. The tax lien companies do NOT pay their own property taxes, leave behind vacant and vandalized property, then flip the property to out-of-state flippers for a couple thousand dollars.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Tax Lien Thieves sue Cuyahoga County Treasurer

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

In which Court is the Tax Lien suit filed?

Can we see the file and copy pertinant pages? What is the basis of the suit against the County. Thanks, I'll come down and copy the file. Best, J

Cuyahoga County Court of Common Pleas - thieves lawsuit

The complaint was filed a few days ago in Cuyahoga County Common Pleas Court.

The information that I have posted recently on these thieves is coming from other sources who are sharing information with me.

Much more has been shared with me from several sources, but the information can not be shared publicly for awhile.

I am not physically able to investigate these thieves like I have been doing for years, so I can not go downtown to pick up a copy of the civil suit myself.

I believe the complaint is relative to proper redemption of tax certificates. In May 2013, the tax redemption process was changed by the county.

Cuyahoga County started collecting the tax certificate redemption payments and attorney fees directly from the property owners. Prior to this change, the redemption payments and attorney fees were sent directly to the tax lien holder by the property owner.

The county now refunds the tax certificate and attorney fees to the tax lien certificate purchaser.

It is possible that the Tax Lien Law Group is suing for an injunction to stop the county from collecting payments, or is suing to have the redemption payments / attorney fees paid directly to the Tax Lien Law Group.

I wonder how much money the county lost from the tax lien sale to these thieves. The thieves do not want to pay their own delinquent property taxes, board-up fees, grass cutting fees and demolition costs.

Not to mention the cost of blight to the neighborhoods, failure to comply with code violations, homelessness, the cost to defend against numerous lawsuits and appeals, dumping condemned property to out-of-state investors who use a UPS mail drop off box as their addresses, etc..

According to the letter below, a total of 12 properties were demolished by the City of Cleveland, three demolished by the county land bank with one pending, and 40 properties have been condemned and will probably require demolition. The average demolition cost is probably near $10,000.

Mr. Mark Parks Treasurer Cuyahoga County Administration Building 1219 Ontario Street, floor Cleveland, OH 44113 June 27, 2013 Dear Mr. Parks, Thank you for attending the meeting on June 17th with VAPAC's Delinquent Tax Committee, in which we discussed Aeon Financial, a firm which has bought tax lien certificates from the county in the past. As you are aware, since the County re-introduced tax lien certificate sales in 2010, VAPAC has worked with County staff to make this process one which is effective, equitable and supports strengthening neighborhoods, while still enhancing the County's tax collection efforts. We have greatly appreciated the responsiveness of the Fiscal Office to incorporating recommended changes into tax lien certificate sales and understand the importance of these sales as a tax collection tool for the county. For that reason, we are very concerned about the potential damage that could be done to the public support and credibility of the tax lien certificate sale process if companies that demonstrate a lack of regard for municipal codes are allowed to participate in the tax lien sale program. This is a topic which we have previously discussed with Fiscal Office staff and as a result we had recommended that the county establish a vetting process that excludes bidders who have a history of non-compliance with municipal codes. Based on the data presented at the meeting as well as the reports from municipal officials who have been dealing with Aeon Financial, the following points clearly emerged at the meeting: 0 Aeon Financial, as a result of foreclosing on tax liens it purchased from the county, currently owns a substantial inventory of 252 properties in Cuyahoga County, with another 158 properties about to come into their possession. Of these, 276 are in the City of Cleveland, and 28.5% are in the suburbs. 0 Of the 276 properties in the City of Cleveland, 40 have been condemned, and at least 12 have already been demolished by the City of Cleveland. The Cuyahoga County Land Reutilization Corporation has demolished at least three suburban properties owned by Aeon, with at least one pending. To date Aeon has not paid for nor accepted responsibility for the demolition costs. In addition, Aeon has repeatedly stated that they do not consider themselves responsible for demolitions paid for by DTAC funds since they were the reason such DTAC fimds are even available. 0 Despite months of meetings and discussions with municipal officials and the Aeon has been unable or unwilling to present a plan of action for responsibly handling the distressed and condemned properties it owns. They are willing to donate properties, but not to cover the associated demolition costs. 0 Aeon has demolished two properties and indicated it has one demolition pending, but no plans for fiirther demolitions. They have indicated that they do not have the funds to demolish condemned properties and instead they plan to continue marketing them through the MLS to the highest bidder, in as-is condition, with no vetting of buyers. Despite their claim of lack of funds, between February and June of 2013, Aeon sold 42 properties in Cuyahoga County which in total grossed them $234,190. 0 Between February and June of 2013, Aeon has already sold three (3) properties condemned by the City of Cleveland, and an additional eight (8) on the city's Distressed Property list. Of the 42 properties they sold between February and June 2013, only 6 sold for more than $10,000, and the average sales price was $5,576. This dumping of low value properties is of grave concern to the community. 0 Aeon's initial response to municipal efforts to enforce their codes was not compliance, but rather a series of aggressive lawsuits which only served to create additional costs for municipalities and delay any beneficial outcome. Aeon finally dropped these lawsuits in April 2013, but has continued to routinely file appeals challenging condemnation actions on properties it owns in the City of Cleveland. Aeon has emphatically stated that it will legally challenge any efforts by the City of Cleveland to enforce its ordinance which holds all property owners in the chain of title responsible for demolition costs, on properties that Aeon owned. Until recently, they have refused to comply with the City of Shaker Heights' foreclosure filing fee ordinance. 0 Aeon indicated that they had requested that the county research taking back liens on properties that are condemned but that have not yet come into Aeon's ownership. You stated that while they have the legal ability to take back liens, it is a tool that will only be used sparingly, and only in rare cases where all parties are in agreement, i.e. the county, the city affected, the lien holder and if applicable, the since it is not the county's responsibility to bail out private entities. In short, what has emerged from Aeon's actions is a picture of a tax lien buyer that either has little willingness to cooperate with municipal officials or lacks the capacity to comply with local housing codes, and instead is actively offloading as many distressed properties as they can without a process to insure a beneficial outcome for our communities. Local research has clearly shown that indiscriminant trading of low value properties (generally considered properties valued under $20,000) has become the scourge of Cuyahoga County communities, creating blight, and setting up a cycle of neighborhood decline. For example, of the extremely low value properties sold between 2004 and 2009, 56% were tax delinquent as of February 2010, and 49% were listed as vacant. (BEYOND REO: Property Transfers at Extremely Distressed Prices in Cuyahoga County, 2005-2008, Claudia Coulton, Michael Schramm, April Hirsh). This is the very reason why the community has worked so hard with the county to prevent condemned and low value properties from being a part of the tax lien sales. Despite best efforts, however, there will always be properties which end up in a deteriorated state by the time they come into the ownership of the tax lien certificate holder, and the business plan for all tax lien certificate buyers must take the responsible disposition of these properties into account. It is not unreasonable for the public to expect that tax lien certificate buyers will be expected to maintain properties they own according to city codes and dispose of them responsibly, just as it would be reasonable to expect them to maintain a history of timely payment of taxes. While the county may not be able to do anything directly about Aeon's current actions, on the other hand, they can certainly take the necessary steps to ensure that there are greater safeguards in place to prevent this type of destabilizing activity by tax lien purchasers in the future. We believe that the county must make every effort to ensure that those who participate in publicly sponsored programs such as the tax lien certificate sale must, at a minimum, be able to demonstrate that they do not have a history of failing to comply with municipal codes, or of attempting to circumvent the law, and of being current in all their tax payments. The county has sought to make transparency and accountability hallmarks of its administration, and requiring participants in the tax lien certificate sale program to demonstrate that they have "clean hands" is totally consistent with that philosophy. At the meeting with VAPAC, the county committed to providing the following: 1. A timeline for the various steps leading up to the September 26, 2013 tax lien sale; 2. A draft for comment of the contract proposed for this next tax lien sale; 3. A draft of the proposed procedures for qualifying bidders to avoid issues such as are currently being faced with Aeon arising in the future; and 4. A list of the companies that had expressed written intent to participate in the next tax lien sale, subject to a review of this request by the County Prosecutor's office. Upon receipt of these items, the VAPAC Delinquent Tax Committee will convene to review these items and provide input as appropriate, as they have done before. Thank you again for working with the community to address these issues and make the tax lien sale process one that we can all support and hold up as beneficial to our communities. If you have specific questions regarding any of the items above, please contact me at 216-407-4156. We look forward to your response to the issues raised above and to working together as we jointly tackle the critical housing issues facing our communities. Chair of VAPAC c.c. Mr. Wade Steen, Fiscal Officer Mr. Ed FitzGerald, County Executive Ms. C. Ellen Connally, County Council President

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Aeon Financial Tax Lien THIEVES - Binarko Properties- En V Us

Numerous properties that Aeon Financial recently sold to an out-of-state flipper - BINARKO PROPERTIES- are now being flipped to another out-of-state investor.

En V Us Investments LLC (located in New Jersey) is purchasing property that Aeon Financial recently sold to Binarko Properties.

En V Us Investments LLC is paying considerably less than Binarko Properties paid Aeon Financial for the property just a few weeks ago.

One example. This property transferred from Aeon Financial to Binarko Properties on 8-12-13 for $3,514.

ON September 6, 2013, Binarko Properties sold the property to EN V US Investment LLC for $500. A $3,014 loss for property purchased from Aeon Financial less than one month ago.

------------------------------------------------------------------------------------------------------------------------------------------------------

Jersey City, New Jersey 73053054

United States

------------------------------------------------------------------------------------------------------------------------------------

There are several property transactions by Binarko Properties LLC which all sell the property for much less than Binarko Properties paid Aeon Financial for the property just a few weeks ago.

Binarko Properties also paid Aeon Financial's realtors considerably more for the property than the realtor had the property listed for on their website, and Binarko purchased IN BULK.

Who's kidding whom?

This scam sounds familiar:

Marc Tow, key figure in major Cleveland housing scam, sentenced to five years in prison

Read more: http://www.newsnet5.com/dpp/news/local_news/investigations/Marc-Tow-key-figure-in-major-Cleveland-housing-scam-sentenced-to-five-years-in-prison#ixzz2hGoMbarI

Binarko's property (recently sold by Aeon Financial) is also being sold to GLOBAL MARKET SALES CO. USA LTD for considerably less than Binarko paid Aeon Financial for the property a few weeks ago.

I believe this property flipping to Binarko Properties is a scam by Aeon Financial to avoid demolition costs, housing court fines for their numerous dumps, and of course paying their OWN property taxes.

The EPA inspectors were at the property located at 6808 Lorain Avenue today:

6808 Lorain Avenue, Cleveland, Ohio

This property will be demolished within a month or so.

Prior to being sold out by the county and losing this property to Aeon Financial for petty delinquent property taxes, the former owner and his family owned this house since 1979.

Per the EPA inspectors, this property will require costly asbestos removal. This property was being used as a dump and has trash to the ceiling.

Aeon owned the above property since May 30, 2012 and never paid property taxes. Property taxes owed $1954.30.

Cuyahoga County taxpayers will pay for this demolition and many other demolitions in which Aeon Financial is attempting to avoid their financial responsibility.

I have to do some laundry today. Everything I own is dirty - filthy dirty. If the tax lein thieves send me a couple bags of their money, I will be more than happy to help them out.

http://www.cleveland.com/metro/index.ssf/2013/05/house_flipper_blaine_murphy_se.html

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

1.9 MILLION $ lawsuit Tax Lien Predators vs Cuyahoga County

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Aeon Financial got their shit torn down today

Aeon Financial got their shit property torn down today.

Although the EPA inspectors were at 6808 Lorain in Cleveland just a few days ago and said that the demolition will require asbestos removal, the demolition contractor today said that he was NOT hired by the city.

This property was being watched 24 /7 and NO asbestos was removed from this property prior to the demolition.

BEFORE:

6808 Lorain Avenue, Cleveland, Ohio

AFTER:

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Meet the Man Behind D.C.’s Predatory Tax Lien Practices

MARK ALAN SCHWARTZ

http://www.washingtoncitypaper.com/blogs/housingcomplex/2013/12/09/meet-the-man-behind-d-c-s-predatory-tax-lien-practices/comment-page-1/#comment-108952

http://www.balloon-juice.com/2013/12/09/worst-person-ever/

The worst person ever & his girlfriend, Y J Hu ( Ya Jia Hu):

Stalking complaint filed by Mark Schwartz's wife

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Aeon Financial Skirting Code Violations

From the Washington Post,

" As Aeon sparred with Cleveland officials, the company began getting rid of the houses. On a single day this summer, Aeon sold 83 to a newly formed limited liability company, records show.

One member of the city council, concerned that Aeon is trying to skirt the code violations, has requested that prosecutors investigate whether the sales were legitimate.

The lead agent for Aeon who signed the deeds was John A. Lord, a former Ohio attorney who was permanently disbarred in 2007 for deceiving and abandoning clients and then keeping their money. He was later convicted of aggravated theft and served one year’s probation, records show." http://www.washingtonpost.com/sf/investigative/2013/12/08/debt-collecting-machine/

Mark Schwartz ( Aeon Financial ) just happens to have a GIRLFRIEND by the name of Y J Hu ( Ya Jia Hu)

Mark Schwartz and his girlfriend Y J Hu

Cuyahoga County taxpayers should not foot the bill for the numerous demolitions required for Aeon's properties.

The city's prosecutor doesn't need to investigate anything. Send the court summons ( which came back as, " Moved, Left NO Address" )

here:

460 El Mirador, Edwards, CO 81632

The property transfer is an obvious scam. Read this comment for more details on the property transfer http://realneo.us/content/aeon-financial-aka-capitalsource-bank-property-tax-foreclosure-thieves-does-not-pay-their-ow#comment-34507

The city should also send delinquent property tax notices to THEIR multi-million dollar Colorado residence.

These thieves are responsible for paying their OWN delinquent property taxes on property they obtained via delinquent property tax foreclosures. common fucking sense.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Aeon Financial transfers more property to Binarko Properties

After receiving ANOTHER mortgage of up to 30 MILLION DOLLARS using Cuyahoga County property as collateral, Aeon Financial transferred seven more properties to the shell LLC, Binarko Properties LLC on December 6, 2013:

Cleveland Housing Court is unable to serve the shell Binarko Properties, LLC court summons' for the following reason:

Who's HU http://realneo.us/content/delinquent-property-tax-liens-fraud-cuyahoga-county#comment-34691

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Oh Lord!

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Oh My!

http://www.sconet.state.oh.us/rod/docs/pdf/8/2013/2013-ohio-1796.pdf

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Oh Boy!

FAKE NOTARY:

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Oh Shit!

Aeon Financial transferred nearly 100 properties to Binarko Properties, LLC.

Binarko Properties is a shell LLC which I believe was created for Aeon Financial to hide their property.

THE ONLY NAME THAT IS REGISTERED WITH THIS LLC IS ' Y J HU" :

.

Who's HU?

Ya Jia Hu is Mark Schwartz's (main player behind Aeon Financial) girfriend, Ya Jia Hu - that's who!

NOTE YA JIA HU'S WORKPLACE: Tax Lien Law Group:

Cleveland Housing Court is having a difficult time attempting to serve the shell LLC Binarko Properties:

Cleveland Housing Court doesn't know who's HU:

Y J Hu AND Mark Schwartz can be found in Colorado:

Our house in Colorado.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Merry early Christmas to me!

Santa came early. Best Christmas present ever!

The thieves got busted!

A million thanks to The Washington Post, Mike Sallah, and all of the other investigative reporters.

To: lily miller

Sent: Sunday, December 8, 2013 3:57 PM

Subject: RE: Tax Lien Foreclosures

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Y J Hu and her boyfriend Mark Schwartz shut down facebook pages

This morning both of their Facebook pages were shutdown.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Aeon is dumping more property

On December 10, 2013, Aeon Financial transferred three properties to BLUE TIDE GROUP LLC.

This LLC is NOT registered with the State of Ohio:

BLUE TIDE GROUP is located in Florida:

CLEARWATER, FL 33765

CLEARWATER, FL 33765

CLEARWATER, FL 33765

Title MGRM

ROBINSON, APRIL D

CLEARWATER, FL 33765

Title MGRM

ROBINSON, JOHN E

CLEARWATER, FL 33765

The property located at 13701 Graham Road in East Cleveland sold for $10.

The property located at 1672 Eddy Road in East Cleveland sold for $250

The property located at 14317 Terrace Road in East Cleveland sold for $ 3,000.

The deeds were signed by disbarred attorney John A Lord.

I feel very confident that Blue Tide LLC - located in Florida- will maintain their property in East Cleveland, Ohio.

NOT!

Blue Tide LLC already has this property on their Facebook Page- flipping property! https://www.facebook.com/bluetidegroup

https://fbstatic-a.akamaihd.net/rsrc.php/v2/yD/r/N8eF8pLkCCD.png

); background-color: rgb(231, 235, 242); margin: 0px; padding: 15px 0px 0px; position: relative; list-style: none; color: rgb(51, 51, 51); font-size: 11px; line-height: 14px; background-position: 50% 0%; background-repeat: no-repeat repeat;">***** $2500 ******

$$$$$$ FANTASTIC PRICE!!!!!

...See More

$$$$$$ FANTASTIC PRICE!!!!!

6 BEDROOMS - 2 BATHROOMS - 3110 SQ FT

SELLING AS IS WHERE IS, CASH FOR DEED, QUIT CLAIM..." width="403" style="height: 389px; min-height: 100%; position: relative;" />

*** PRICED TO MOVE FAST - ACT NOW *** $2500

HANDYMAN SPECIAL - FIXER UPPER

...See More

HANDYMAN SPECIAL - FIXER UPPER

2 BEDROOM - 1 BATH - 960 SQ FT

SELLING AS IS WHERE IS, CASH FOR DEED, QUIT CLAIM..." style="height: auto; min-height: 100%; position: relative; width: 403px;" />

Meanwhile, county officials are scratching their empty heads trying to figure out why all the people left this county.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Aeon transfers more property to Binarko Properties

On December 16, 2013, the master minds behind Aeon Financial transferred 11 more properties to the shell LLC, Binarko Properties.

Aeon Financial's half-assed attorneys filed mortgages for all of the properties BEFORE they filed the deeds. Pure genuis legal team!

The mortgages were filed on December 12, 2013.

It should be common sense for Aeon Financial's half assed attorneys to record the deed prior to the mortgage.

The deeds were prepared by Aeon Financial's disbarred attorney John A. Lord, dated September 15, 2013, and filed on December 16, 2013.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Shell Binarko Properties attempts to sell house for $150.00

The shell Binarko Properties is attempting to sell a house for $150.00.

Cleveland, OH 44109

1) Buyer to assume any and all closing costs. 2) Buyer to assume all tax delinquencies. 3) There is no proration made by seller, ie: not tax proration, or no proration of delinquent water balances, etc. 4) Failure to comply with the terms of the contract (ex: failing to close on the date of closing) will result in the forfeiture of buyer's earnest money deposit. 5) Property is being sold 'as is, where is'. 6) Buyer to assume any and all violations. http://www.movoto.com/cleveland-oh/3541-trowbridge-ave-cleveland-oh-44109-831_3465149/

The shell LLC, Binarko Properties allegedly paid $3,227 on Augut 12, 2013 and now they are going to sell the property for $150.

I believe Mark Schwartz's girlfriend Y J HU has money to burn if she is able to take such a financial hit on this property:

Aeon Financial has never paid their OWN property taxes since the September 11, 2012 transfer, and his girlfriend never paid taxes either.

And another $150 house which Binarko Properties, aka Mark Schwartz's girfriend is attempting to sell:

The two love birds, Tax Lien King Mark Schwartz and Tax Lien Whore Y J HU (alleged stalker) , are living it up in their castle, while fucking up our neighborhoods.

whore: A person considered as having compromised principles for personal gain.

In August 2013, Aeon Financial transferred nearly 100 properties to the shell LLC, Binarko Properties.

I am willing to bet that they are all for sale for pennies on the dollar and for much less than the fake Binarko Properties paid and have mortgages for.

Check out this list - including $50 houses . I can't research them, but it is a safe bet all of Binarko owned properties are on this list. http://www.movoto.com/property/oh/cleveland.html

Cleveland

Cleveland

Cleveland

Cleveland

Cleveland

Cleveland

Listing Courtesy Of

of

One of the $50 properties is on the CONDEMNED list and more than likely in need of demolition, 4185 Lee Road. If you can afford the demolition cost, this is a great deal! http://planning.city.cleveland.oh.us/bza/bbs/agenda/2012/AGENDA10242012.pdf

Thank D. Hill for the info. ;)

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Binarko dumping property

Aeon Financial's shell LLC, Binarko Properties, is now dumping property.

Recent property transfers for Binarko Properties:

Cleveland's Housing Court was unable to serve the fake Binarko Properties with a court summons as the mail was returned, " MOVED LEFT NO ADDRESS - UNDELIVERABLE AS ADDRESSED "

Cleveland Housing Court is now attempting bailiff service on the shell Binarko Properties. A court date is scheduled for 1/9/14.

Aeon Financial Tax Lien Thieves also have several pending cases in Cleveland Housing Court. A court date for Aeon is scheduled for 1/6/14. Aeon's half assed attorneys will face Judge Pianka, and hopefully Mark Schwartz will be ordered to appear, along with his girlfriend Y J HU. Aeon's disbarred attorney John Lord won't be able to practice law in the courtroom, so they will probably send in the fake notary/ half ass attorney Kirk Liederbach. I believe Judge Pianka will step up to the plate and put these thieves in their place. Pianka should sentence Mark Schwartz, his family members, and girlfriend Ya Jia Hu to house arrest in one of their dumps they are trying to sell for $250.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Binarko Properties & Aeon Financial dumping more property

Who brought these thieves into our county????

What was the vetting process???

Why are other Ohio county contracts with tax lien companies charging their folks less than 18% interest, and our folks are stuck with the maximum allowed 18% interest?

Were there any other bids for our county's contract for tax lien sales??

Cuyahoga County has 'negotiated' tax lien sales. Why do tax lien investors themselves find this 'interesting'???

November 4, 2011 at 6:01am ·

______________________________________________________________________________________________________________________________

Binarko Properties is dumping property again.

Sold for the grand sum of $99 although Binarko had a mortgage to Aeon on this property for $ 2,933.

NO property taxes paid for this property since the original transfer to Aeon Financial on 9/11/12.

Property taxes owed $3650.18

AND the following property which Binarko sold for $1500. Binarko paid Aeon $3156 for this property in August 2013 and had a mortgage to Aeon for $3156.

NO property taxes were ever paid by Aeon Financial since the April 19, 2012 tranfer date.

*** Y J HU from Binarko Properties is still ' flipping property' in our county; however defendant Y J HU believes she is too good to appear in our court. Binarko's attorney filed a motion requesting that the defendant be excused from attending court- which I assume is because she just gave birth. If she is well enough to continue flipping property, then she is well enough to appear in court. NO excuse ***

Y J Hu / Binarko Properties has the ability to list numerous properties with a realtor, and then flip numerous properties constantly in January 2014, but she can't appear in housing court.

She hasn't yet appeared either- despite having a warrant issued for her arrest. Where is the bond to insure she does appear? The court was unable to serve her once already, so why give her a second chance to avoid the legal system?

Why is she getting special treatment? Every other criminal defendant has to appear or they have a bench warrant.

The housing court cases for both Aeon Financial and Binarko Properties will be closely monitored to insure that Aeon and Binarko Properties receive what they have coming to them.

I encourage as many folks as possible to attend the court proceedings for both Aeon Financial and Binarko Properties.

MOTION FILED BY DEFENDANT

MOTION/DEMAND FOR DISCOVERY FILED BY PROSECUTOR

JURY DEMAND FILED WITH CLERK

CASE ASSIGNED TO THE PERSONAL DOCKET OF:

HEARING SCHEDULED:

ALERT CANCELLED

CAPIAS ORDERED RECALLED

STATUTORY PERIOD WAIVED - EXECUTED COPY IN FILE

CONTINUED AT DEFENDANTS REQUEST

PLEAD NOT GUILTY

LETTER TO DEFENDANT FOR CAPIAS TO BE PROCESSED AND MAILED

ALERT ISSUED

SUMMARY OF ACTIONS IN COURT:

WARRANT TO ISSUE

UNDELIVERABLE AS ADDRESSED

CERTIFIED MAIL ISSUED

HOUSING SUMMONS ORDERED ISSUED

COMPLAINT FILED WITH CLERK

BASIC COURT COSTS

BACK FILED IMAGES

ALL

Descending

Aeon Financial also sold the following property on September 12, 2013:

The original owner of the above property owned this property since at least 1975.

The half ass attorney for Aeon Financial had to refile a corrected deed since the half ass attorney -who practices in real estate - forgot to add the parcel # on the deed.

According to the Ohio Secretary, B & T uses a mailing address of 4758 Ridge Road, # 230, Brooklyn, Ohio.

This address is a mail drop off box at the UPS Store:

LOCALLY OWNED AND OPERATED.4758 RIDGE RD

BROOKLYN, OH 44144

Aeon Financial aka Binarko Properties is dumping some of their property to an out-of-state shady flipper who sells real estate on Facebook. Several Cleveland properties are already featured on this Facebook page, and this comment was added today:

And finally, the 2nd writ of mandamus filed by the Tax Lien Law Group ( Mark Schwartz / Aeon Financial ) against Cuyahoga County relative to Lakeview Holdings tax lien payments was denied:

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

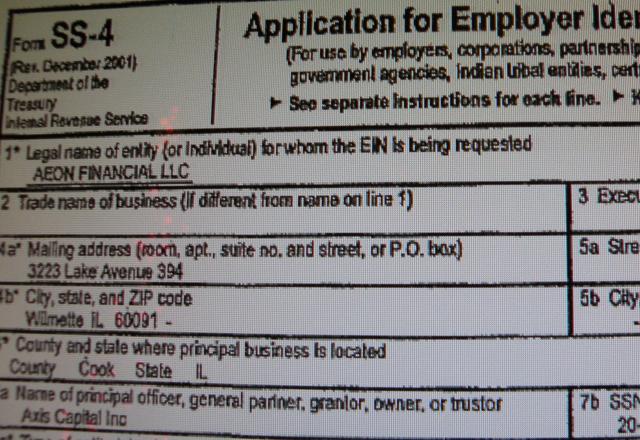

Aeon Financial Tax Documents detailing ownership

*

On January 23, 204, the Tax Lien Law Group ( Aeon Financial / Mark Schwartz) and Woods Cove II reached a settlement in New York :

And on January 24, 2014, the Tax Lien Law Group ( Mark Schwartz / Aeon Financial) and Woods Cove II settled their lawsuit in Summit County:

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Motivation

http://www.washingtonpost.com/sf/investigative/2013/09/08/left-with-nothing/

AND http://www.washingtonpost.com/sf/investigative/2013/09/10/mistakes-put-homes-in-peril/?tid=ts_carousel

Aeon Financial has engaged in bid rigging tax leins sales http://www.washingtonpost.com/sf/investigative/2013/09/09/suspicious-bidding/

Our incompetent officials would rather have their greedy hands on the millions of dollars received from the tax lien thieves than deal with the fraud, lack of the tax lien thieves paying their own delinquent property taxes on property in which they foreclosed upon for delinquent property taxes, along with the hundreds of blighted properties owned by the tax liens thieves which taxpayers pay to maintain by board-up costs, grass cutting fees, etc.

" Cordi, with the tax office, acknowledged that the agency never went back to review the bidding in the District for signs of wrongdoing after the Maryland criminal case became public. D.C. law requires the agency to cancel any sales where fraud is found. Cordi also said the tax office doesn’t have the authority to ban bidders who get in trouble in other places — and wouldn’t necessarily want to. “If you exclude bidders, you take in less money,” he said."

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Aeon Financial's solution to building code violations

6808 Lorain Avenue, Cleveland, Ohio

Aeon Financial's solution to building code violations?

Transfer the property, along with numerous other properties, to an out-of-state shell LLC who uses a UPS mail drop off box:

2013 CRB 026921 STATE OF OHIO / CITY OF CLEVELAND -VS- AEON FINANCIAL LLC ADMINH

AEON FINANCIAL LLC DEFENDANT KASUNICK, JOSEPHOFFICER/COMPLAINANT

6808 LORAIN AVEPROPERTY ADDRESS

Who will pay for the demolition on this property in which large portions of the roof are missing, ceiling and floors caving in, along with foundation issues?

Who will pay Aeon Financial's OWN delinquent property taxes which have not been paid since the May 30, 2012 transfer to Aeon via a delinquent property tax foreclosure?

I believe the person behind Aeon Finanicial, ATTORNEY MARC ALLEN SCHWARTZ, should pay for this.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Delinquent property tax lien sale cancelled amid controversy

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

DC considers compensating property owners who lost property

http://wamu.org/news/13/09/20/dc_could_compensate_residents_who_lost_homes_through_tax_lien_sales

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Cuyahoga County should follow the leaders>STOP TAX LIEN SALES

I implore Cuyahoga County; who uses these tax lien sales as leverage for Securities-----to STOP THEM and find new ways to "BALANCE" the budget without creating undue hardship for homeowners................................................................Respectfully.

The link above states the following:

The D.C. government is looking into compensating homeowners who lost their properties through the city's tax lien program.

After a Washington Post investigation detailed how elderly residents lost their homes because of small unpaid tax bills that ballooned into much larger fees, the D.C. Council is taking steps to reform the tax lien program.

D.C. Council member Mary Cheh (D-Ward 3) introduced emergency legislation asking the audit office to go back and study the foreclosures caused by tax liens where the amount was $2500 or less.

"And then to look and see whether there are reasons of excusable neglect or our mistake or equitable considerations that would make any of this a candidate for some sort of compensation," she said.

Cheh says she has no idea how much it could cost taxpayers to potentially compensate these homeowners.

In the meantime, the city has halted its tax lien program and cancelled dozens of tax liens sold at an auction two months ago. The Council also approved emergency legislation capping the fees charged to homeowners.

Always Appreciative, "ANGELnWard14"

Cuyahoga County 2013 Tax Liens sold to Aeon Financial's cousin

Cuyahoga County sold out their people once again.

http://www.cleveland.com/cuyahoga-county/index.ssf/2013/09/cuyahoga_county_council_agenda_includes_selling_buildings_tax_liens.html#incart_river_default

The 2013 tax liens were sold to Woods Cove III.

The folks behind Aeon Financial and Woods Cove are cousins - literally.

**************************************************************************************************************************************************

Live update:

Council just approved that $25 million sale of property tax liens.

Councilman Dale Miller said Woods Cove will make efforts to notify property owners, and they will work with community development corporations to decide which buildings to foreclose on.

County gets the money up front, Woods Cove makes a profit by tacking on fees when they collect the delinquent taxes. No debate.