Submitted by Gone Fishin on Sat, 06/29/2013 - 19:24.

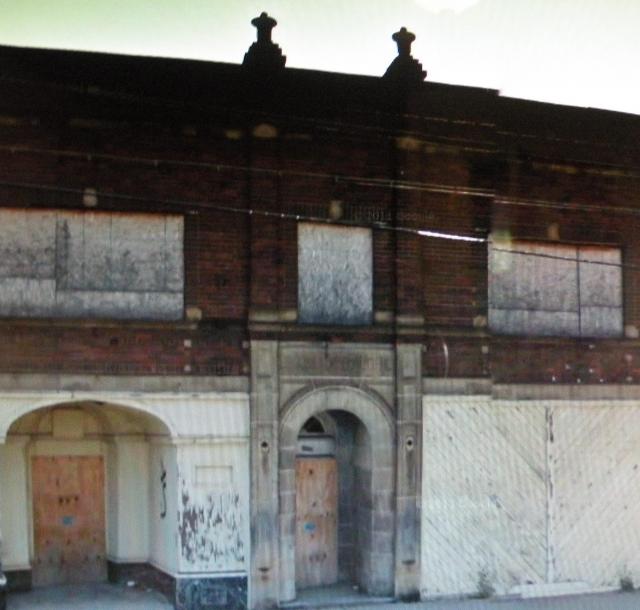

3555 Fulton Road , Cleveland, Ohio

Summary: Attorney Guests Wanted for Weekly Real Estate Radio Show

Name: Brain Stark

Show Description: Open line talk format. We discuss real estate from every angle. We are info-tainment, NOT a dry statics show.Residential, commercial, finance, government issues, landlording, big development, housing issues, legal issues, foreclosure, mortgages, banking, from Fisherman’s Wharf to a small house in Detroit, we discuss it all.

Brian Stark http://www.legalplayground.com/925-the-stark-group-live-radio-show-seeks-real-estate-attorney-guests.html

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Gus Frangos, President of the Cuyahoga County Land Bank, appeared on Stark Group LIVE Radio Show:

In September, Gus Frangos appeared on "Stark Group Live," a real estate talk show on WERE-AM Radio in Cleveland. The broadcast began with the basics: host Paul Stark asked Frangos whether

he

"takes" or "gives" properties and Frangos explained the strategy of acquiring low-value properties and eliminating blight by either demolishing the houses or rehabbing them. "It's not just a matter of getting rid of what's bad," Frangos told Stark. "There's some strategy to it.

http://www.zoominfo.com/#!search/profile/person?personId=394184590&targetid=profile

__________________________________________________________________________________________________________________________________________________________________________

I believe both Gus Frangos and Brian Stark are well aware of their strategy.

The above property located at 3555 Fulton Road in Cleveland, Ohio was previously owned by two LLC's connected to Brian Stark -- STARK GROUP LLC & STEPPING STONE PROPERTIES LLC.

| Entity Number |

1049300 |

| Business Name |

THE STARK GROUP LLC |

| Filing Type |

DOMESTIC LIMITED LIABILITY COMPANY |

| Status |

Active |

| Original Filing Date |

12/17/1998 |

| Expiry Date |

|

|

|

|

| Agent / Registrant Information |

J. NORMAN STARK

526 SUPERIOR AVE NE #960

CLEVELAND,OH 441141401

Effective Date: 12/17/1998

Contact Status: Active |

| Incorporator Information |

J. NORMAN STARK

CAROLE DEE STARK

BRIAN D STARK

SHARON F. STARK

PAUL J. STARK

MARIE F. O'LEARY-STARK |

|

|

| Entity Number |

1167319 |

| Business Name |

STEPPING STONE PROPERTIES, LLC, AN OHIO LIMITED LIABILITY COMPANY |

| Filing Type |

DOMESTIC LIMITED LIABILITY COMPANY |

| Status |

Active |

| Original Filing Date |

06/01/2000 |

| Expiry Date |

|

|

|

|

| Agent / Registrant Information |

BRIAN STARK

15615 WATERLOO RD

CLEVELAND,OH 441100000

Effective Date: 06/01/2000

Contact Status: Active |

| Incorporator Information |

| BRIAN STARK |

| Filings |

Filing Type

Date of Filing

Document Number/Image

| ARTICLES OF ORGANIZATION/DOM. LIMITED LIABILITY CO |

06/01/2000 |

200015900131 |

|

3555 Fulton Road was first purchased by Stark Group LLC on December 28, 2000:

| Transfer Date: 28-DEC-00 |

AFN Number: 200012280786 |

Receipt: 30463A |

| Parcel |

Deed Type |

Vol / Page |

Sales Amt |

Convey. Fee |

Convey. No |

Multiple Sale / No. of Parcels |

| 015-12-102 |

Warranty Deed |

00000 / 0000 |

$72,500 |

$290 |

0 / 0 |

| |

| Grantee(s) |

Grantor(s) |

| |

|

|

|

On August 26, 2004, the property transferred from Stark Group LLC to Stepping Stone LLC - both LLCs are connected to Brian Stark:

| Transfer Date: 26-AUG-04 |

AFN Number: |

Receipt: |

| Parcel |

Deed Type |

Vol / Page |

Sales Amt |

Convey. Fee |

Convey. No |

Multiple Sale / No. of Parcels |

| 015-12-102 |

Quit Claim Deed Ex |

/ |

$0 |

$0 |

0 / 1 |

| |

| Grantee(s) |

Grantor(s) |

| |

| STEPPING STONE PROPERTIES LLC |

|

|

|

|

No property taxes were ever paid since the original December 28, 2000 transfer date and the delinquent balance was $35,608.34:

| |

| |

CHARGES |

PAYMENTS |

BALANCE DUE |

|

| TAX BALANCE SUMMARY: |

35,608.34 |

0.00 |

35,608.34 |

|

| 2010 (pay in 2011) CHARGE AND PAYMENT DETAIL |

Tax Information is up to the hour - tell me more. |

| TAXSET |

CHARGE TYPE |

CHARGES |

PAYMENTS |

BALANCE |

| Cleveland |

Prior year penalty - 2005 |

335.11 |

0.00 |

335.11 |

| Prior year penalty - 2008 |

375.84 |

0.00 |

375.84 |

| Prior year penalty - 2002 |

279.93 |

0.00 |

279.93 |

| Prior year penalty - 2001 |

88.59 |

0.00 |

88.59 |

| Prior year penalty - 2006 |

372.56 |

0.00 |

372.56 |

| Prior year penalty - 2007 |

370.85 |

0.00 |

370.85 |

| Prior year penalty - 2004 |

298.59 |

0.00 |

298.59 |

| Prior year penalty - 2003 |

297.54 |

0.00 |

297.54 |

| Prior year penalty - 2009 |

376.09 |

0.00 |

376.09 |

| Prior year tax - 2002 |

1,806.02 |

0.00 |

1,806.02 |

| Prior year tax - 2008 |

2,424.78 |

0.00 |

2,424.78 |

| Prior year tax - 2001 |

885.90 |

0.00 |

885.90 |

| Prior year tax - 2009 |

2,426.32 |

0.00 |

2,426.32 |

| Prior year tax - 2005 |

2,161.94 |

0.00 |

2,161.94 |

| Prior year interest - 2008 |

1,286.93 |

0.00 |

1,286.93 |

| Prior year interest - 2003 |

102.35 |

0.00 |

102.35 |

| Prior year interest - 2009 |

1,004.78 |

0.00 |

1,004.78 |

| Prior year interest - 2005 |

318.22 |

0.00 |

318.22 |

| Prior year tax - 2006 |

2,403.54 |

0.00 |

2,403.54 |

| Prior year tax - 2004 |

1,926.30 |

0.00 |

1,926.30 |

| Prior year tax - 2003 |

1,919.50 |

0.00 |

1,919.50 |

| Prior year tax - 2007 |

2,392.54 |

0.00 |

2,392.54 |

| Prior year interest - 2004 |

158.09 |

0.00 |

158.09 |

| Prior year interest - 2002 |

22.74 |

0.00 |

22.74 |

| Prior year interest - 2006 |

542.63 |

0.00 |

542.63 |

| Prior year interest - 2007 |

981.33 |

0.00 |

981.33 |

| Delq Interest - 2010 |

2,325.95 |

0.00 |

2,325.95 |

| Prior year August interest - 2010 |

606.83 |

0.00 |

606.83 |

| DELQ BALANCE |

28,491.79 |

0.00 |

28,491.79 |

| 1st half penalty |

121.43 |

0.00 |

121.43 |

| 1st half tax |

1,214.26 |

0.00 |

1,214.26 |

| 1ST HALF BALANCE |

1,335.69 |

0.00 |

1,335.69 |

| 2nd half penalty |

255.00 |

0.00 |

255.00 |

| 2nd half tax |

1,214.26 |

0.00 |

1,214.26 |

| 2ND HALF BALANCE |

1,469.26 |

0.00 |

1,469.26 |

| M221020A-Board Up |

Delq Interest - 2010 |

38.28 |

0.00 |

38.28 |

| Prior year interest - 2007 |

9.19 |

0.00 |

9.19 |

| Prior year interest - 2008 |

28.82 |

0.00 |

28.82 |

| Prior year interest - 2009 |

19.35 |

0.00 |

19.35 |

| Prior year Aug SPA fee int - 2010 |

0.11 |

0.00 |

0.11 |

| Prior year tax - 2006 |

298.50 |

0.00 |

298.50 |

| Prior year August interest - 2010 |

10.73 |

0.00 |

10.73 |

| Prior year SPA fee penalty - 2006 |

0.47 |

0.00 |

0.47 |

| Prior year SPA fee interest - 2009 |

0.19 |

0.00 |

0.19 |

| Prior year SPA fee interest - 2007 |

0.09 |

0.00 |

0.09 |

| Prior year SPA fee interest - 2008 |

0.29 |

0.00 |

0.29 |

| Prior year SPA fee - 2006 |

2.98 |

0.00 |

2.98 |

| Prior year penalty - 2006 |

46.28 |

0.00 |

46.28 |

| DELQ BALANCE |

455.28 |

0.00 |

455.28 |

| C990007-Cuyahoga County (omitted tax) |

Prior year penalty - 2005 |

0.04 |

0.00 |

0.04 |

| Prior year August interest - 2010 |

0.01 |

0.00 |

0.01 |

| Prior year interest - 2008 |

0.03 |

0.00 |

0.03 |

| Prior year tax - 2005 |

0.42 |

0.00 |

0.42 |

| Prior year interest - 2006 |

0.01 |

0.00 |

0.01 |

| Prior year interest - 2007 |

0.03 |

0.00 |

0.03 |

| Prior year interest - 2009 |

0.02 |

0.00 |

0.02 |

| DELQ BALANCE |

0.56 |

0.00 |

0.56 |

| M221020E-BOARD UP |

Prior year penalty - 2009 |

215.54 |

0.00 |

215.54 |

| Delq Interest - 2010 |

178.53 |

0.00 |

178.53 |

| Prior year SPA fee penalty - 2009 |

2.17 |

0.00 |

2.17 |

| Prior year SPA fee - 2009 |

13.90 |

0.00 |

13.90 |

| Prior year tax - 2009 |

1,390.50 |

0.00 |

1,390.50 |

| DELQ BALANCE |

1,800.64 |

0.00 |

1,800.64 |

| M221020C-BOARDUP LIENS |

Prior year penalty - 2007 |

162.29 |

0.00 |

162.29 |

| Prior year SPA fee - 2007 |

10.48 |

0.00 |

10.48 |

| Prior year SPA fee interest - 2008 |

0.32 |

0.00 |

0.32 |

| Prior year SPA fee interest - 2009 |

0.63 |

0.00 |

0.63 |

| Prior year SPA fee penalty - 2007 |

1.61 |

0.00 |

1.61 |

| Prior year August interest - 2010 |

34.78 |

0.00 |

34.78 |

| Prior year Aug SPA fee int - 2010 |

0.35 |

0.00 |

0.35 |

| Delq Interest - 2010 |

134.31 |

0.00 |

134.31 |

| Prior year interest - 2008 |

32.25 |

0.00 |

32.25 |

| Prior year interest - 2009 |

62.77 |

0.00 |

62.77 |

| Prior year tax - 2007 |

1,047.00 |

0.00 |

1,047.00 |

| DELQ BALANCE |

1,486.79 |

0.00 |

1,486.79 |

| M119348C-GRASS CUTTING |

Prior year penalty - 2008 |

65.47 |

0.00 |

65.47 |

| Prior year SPA fee - 2008 |

4.22 |

0.00 |

4.22 |

| Prior year SPA fee interest - 2009 |

0.08 |

0.00 |

0.08 |

| Prior year SPA fee penalty - 2008 |

0.65 |

0.00 |

0.65 |

| Prior year August interest - 2010 |

13.23 |

0.00 |

13.23 |

| Prior year Aug SPA fee int - 2010 |

0.13 |

0.00 |

0.13 |

| Delq Interest - 2010 |

54.12 |

0.00 |

54.12 |

| Prior year interest - 2009 |

8.13 |

0.00 |

8.13 |

| Prior year tax - 2008 |

422.30 |

0.00 |

422.30 |

| DELQ BALANCE |

568.33 |

0.00 |

568.33 |

| TOTAL BALANCE |

35,608.34 |

0.00 |

35,608.34 |

|

Property taxes simply overlooked for the connected Brian Stark for over 10 YEARS.

On April 18, 2011, the new Cuyahoga County Treasurer started cleaning up Jim Rokakis' mess and finally filed a Tax Foreclosure:

| Case Number: |

CV-11-753398 |

| Case Title: |

TREASURER OF CUYAHOGA COUNTY, OHIO vs. STEPPING STONE PROPERTIES LLC, ET AL |

| Case Designation: |

TAX FORECLOSURE |

| Filing Date: |

04/18/2011 |

| Judge: |

ANNETTE G BUTLER |

| Magistrate |

PAUL LUCAS |

| Room: |

N/A |

| Next Action: |

N/A |

| File Location: |

DF-ROOM 45 |

| Last Status: |

INACTIVE |

| Last Status Date: |

02/16/2012 |

| Last Disposition: |

DISP.OTHER |

| Last Disposition Date: |

02/15/2012 |

| Prayer Amount: |

$.00 |

| TREASURER OF CUYAHOGA COUNTY OHIO |

| C/O JUSTICE CENTER 9TH FLOOR |

| 1200 ONTARIO STREET |

| CLEVELAND, OH 44113-0000 |

|

|

|

|

| ADAM D. JUTTE (0081671) |

| THE JUSTICE CENTER - COURT TOWER |

| 1200 ONTARIO ST - 9TH FLOOR |

| CLEVELAND, OH 44113-0000 |

| Ph: 216-443-7797 |

| Answer Filed: N/A |

|

|

|

|

|

|

|

| STEPPING STONE PROPERTIES LLC |

| % SECRETARY OF THE STATE OF OHIO |

| 180 EAST BROAD STREET 15TH FLOOR |

| COLUMBUS, OH 43266-0000 |

|

|

|

|

|

| STARK GROUP LLC |

| % SECRETARY OF STATE OF OHIO |

| 180 EAST BROAD STREET 15TH FLOOR |

| COLUMBUS, OH 43266-0000 |

|

|

The tax foreclosure process for this case does not follow the standard process for auctioning off property.

The normal and legal process for sheriff sale is to offer the property for auction. If there are no bidders at the first sale, the sheriff will hold a second and final sheriff sale.

According to docket entries for this case, the first sheriff sale was scheduled for April 16, 2012 with a second sale date scheduled for April 30, 2012.

According to the docket entries dated 5/15/2012, it specifically states, " Returned 4/18/2012. NO SALE FORFEITED TO STATE"

The NO SALE FORFEITURE date is returned 4/18/12; however the second and final auction was not scheduled until April 30, 2012:

| 05/23/2012 |

N/A |

JE |

ORDER OF FORFEITURE..OSJ. NOTICE ISSUED |

| 05/15/2012 |

N/A |

CS |

ORDER OF SALE Parcel Number: 015-12-102 ORDER OF SALE, WITH REPORT OF SALE ATTACHED, RETURNED 04/18/2012. "NO SALE" -FORFEITED TO STATE. NO SALE FORECLOSURE CLERK FEE - $5.00 LEGAL NEWS ABSTRACT $ 5.00 *****SHERIFF FEES***** NOTICE TO PRINTER 3.00 SERVICE & RETURN 9.00 POUNDAGE(*) 0.00 COST OF DEED PREPERATION 0.00 LEGAL NEWS 111.00 =======TOTAL OF FEES $123.00 . |

| 05/15/2012 |

N/A |

CS |

LEGAL NEWS ABSTRACT $ 5.00 |

| 05/15/2012 |

N/A |

CS |

NO SALE FORECLOSURE CLERK FEE - $5.00 |

| 03/16/2012 |

N/A |

OS |

ON THIS DATE 03/16/2012 ORDER OF SALE ISSUED TO SHERIFF - OTHER LAND. THE ABOVE CAPTIONED CASE IS SCHEDULED FOR SHERIFF SALES ON 04/16/2012 AT 10:00 AM AT JUSTICE CENTER AUDITORIUM 1200 ONTARIO ST CLEVE OHIO 44113 IF THE PROPERTY IS NOT SOLD AT FIRST SALE A SECOND SALE AT THE SAME LOCATION IS SCHEDULED FOR 04/30/2012 AT 10:00 AM NOTICE ISSUED |

This property in control of Brian Stark of Stark Group LIVE Real Estate Radio show was tax delinquent $ 35, 608.34.

On October 31, 2012, the property transferred to Larry Underwood for $745. SEVEN HUNDRED FORTY FIVE DOLLARS

The $35,608.34 tax delinquency was wiped out and reduced to $0

This property never made it to the Cuyahoga County Land Bank.

| Transfer Date: 31-OCT-12 |

AFN Number: |

Receipt: |

| Parcel |

Deed Type |

Vol / Page |

Sales Amt |

Convey. Fee |

Convey. No |

Multiple Sale / No. of Parcels |

| 015-12-102 |

Fiscal Officer Ex |

/ |

$0 |

$0 |

0 / 1 |

| |

| Grantee(s) |

Grantor(s) |

| |

|

|

| STATE OF OHIO (FORF) CASE # CV 753398 |

|

This is not the only property tax foreclosure case filed against Stark Group LLC and Stepping Stone Properties LLC.

Type

Last Name

First Name

M. Name

Detail

| R |

STARK GROUP LLC |

Grantee

|

|

|

Type

Last Name

First Name

M. Name

Detail

| E |

STEPPING STONE PROPS LLC |

|

Legal Description

| Category |

Value |

| Sublot: |

71 |

| Original Lot: |

409 |

| Township: |

100 ACRE |

| Street Name: |

E 103 |

| Parcel #: |

121-18-066 |

|

The property located at 2202 East 103rd Street in Cleveland, Ohio originally transferred to Stark Group LLC on October 16, 2002.

| Transfer Date: 16-OCT-02 |

AFN Number: 200210160872 |

Receipt: 25785A |

| Parcel |

Deed Type |

Vol / Page |

Sales Amt |

Convey. Fee |

Convey. No |

Multiple Sale / No. of Parcels |

| 121-18-066 |

Warranty Deed |

00000 / 0000 |

$18,500 |

$74 |

0 / 0 |

| |

| Grantee(s) |

Grantor(s) |

| |

|

|

|

|

On August 2, 2004, the property transferred from Stark Group LLC to Stepping Stone Properties LLC:

| Transfer Date: 26-AUG-04 |

AFN Number: |

Receipt: |

| Parcel |

Deed Type |

Vol / Page |

Sales Amt |

Convey. Fee |

Convey. No |

Multiple Sale / No. of Parcels |

| 121-18-066 |

Quit Claim Deed Ex |

/ |

$0 |

$0 |

0 / 1 |

| |

| Grantee(s) |

Grantor(s) |

| |

| STEPPING STONE PROPERTIES LLC |

|

|

|

|

No property taxes were paid since 2006. Delinquent property taxes owed $ 7,049.46

Cuyahoga County officials also filed a tax foreclosure for this property:

| Case Number: |

CV-09-713945 |

| Case Title: |

JAMES ROKAKIS, AS TREASURER vs. STEPPING STONE PROPERTIES, LLC, ET AL |

| Case Designation: |

TAX FORECLOSURE |

| Filing Date: |

12/23/2009 |

| Judge: |

NANCY MARGARET RUSSO |

| Magistrate |

JOHN T DYKE |

| Room: |

N/A |

| Next Action: |

N/A |

| File Location: |

DF-ROOM 45 |

| Last Status: |

INACTIVE |

| Last Status Date: |

09/09/2010 |

| Last Disposition: |

DISP.OTHER |

| Last Disposition Date: |

09/08/2010 |

| Prayer Amount: |

$.00 |

There were no bidders at either auction, so the property transferred to the Cuyahoga County Land Bank - unlike the property located at 3555 Fulton that was offered for sale once, never transferred to the county land bank, and sold for $745

| 01/19/2011 |

N/A |

JE |

PLAINTIFF'S MOTION FOR FORFEITURE FILED ON 1/11/11 IS GRANTED. ORDER OF FORFEITURE. OSJ. CLRDT 01/19/2011 NOTICE ISSUED |

| 01/11/2011 |

P1 |

MO |

P1 JAMES ROKAKIS AS TREASURER OF CUYAHOGA COUNTY OHIO MOTION FOR FORFEITURE ADAM D. JUTTE 0081671 01/11/2011 - GRANTED |

| 01/05/2011 |

N/A |

CS |

ORDER OF SALE Parcel Number: 121-18-066 ORDER OF SALE, WITH REPORT OF SALE ATTACHED, RETURNED 12/29/2010. NO SALE - FORFEITED TO STATE. NO SALE FORECLOSURE CLERK FEE - $5.00 LEGAL NEWS ABSTRACT $ 5.00 *****SHERIFF FEES***** NOTICE TO PRINTER 3.00 SERVICE & RETURN 8.00 POUNDAGE(*) 0.00 COST OF DEED PREPERATION 0.00 LEGAL NEWS 108.00 =======TOTAL OF FEES $119.00 . |

| 01/05/2011 |

N/A |

CS |

LEGAL NEWS ABSTRACT $ 5.00 |

| 01/05/2011 |

N/A |

CS |

NO SALE FORECLOSURE CLERK FEE - $5.00 |

| 11/05/2010 |

N/A |

OS |

ON THIS DATE 11/05/2010 ORDER OF SALE ISSUED TO SHERIFF - OTHER LAND. THE ABOVE CAPTIONED CASE IS SCHEDULED FOR SHERIFF SALES ON 12/06/2010 AT 10:00 AM AT JUSTICE CENTER AUDITORIUM 1200 ONTARIO ST CLEVE OHIO 44113 IF THE PROPERTY IS NOT SOLD AT FIRST SALE A SECOND SALE AT THE SAME LOCATION IS SCHEDULED FOR 12/20/2010 AT 10:00 AM NOTICE ISSUED |

| Transfer Date: 29-AUG-12 |

AFN Number: |

Receipt: |

| Parcel |

Deed Type |

Vol / Page |

Sales Amt |

Convey. Fee |

Convey. No |

Multiple Sale / No. of Parcels |

| 121-18-066 |

Fiscal Officer Ex |

/ |

$0 |

$0 |

0 / 1 |

| |

| Grantee(s) |

Grantor(s) |

| |

| CUYAHOGA COUNTY LAND REUTILIZATION CORP. |

|

|

| STATE OF OHIO FORFEITURE CS# 713945 |

|

|

The $7049.46 delinquent property taxes were wiped out.

There are several other property tax foreclosures filed against Stepping Stone LLC and Stark Group LLC:

| STEPPING STONE PROPERTIES LLC |

1310 EAST 49TH STREET |

DEFENDANT |

BR-11-004217 |

TREASURER OF CUYAHOGA COUNTY, OHIO v STEPPING STONE PROPERTIES, LLC, ET AL |

| STEPPING STONE PROPERTIES LLC |

SECRETARYOF THE STATE OF OHIO |

DEFENDANT |

BR-11-004217 |

TREASURER OF CUYAHOGA COUNTY, OHIO v STEPPING STONE PROPERTIES, LLC, ET AL |

| STEPPING STONE PROPERTIES LLC |

C/O SECRETARY OF THE STATE OF OHIO |

DEFENDANT |

BR-12-005391 |

TREASURER OF CUYAHOGA COUNTY, OHIO v STEPPING STONE PROPERTIES LLC ET AL |

| STEPPING STONE PROPERTIES LLC |

15615 WATERLOO ROAD |

DEFENDANT |

CV-06-582451 |

PLYMOUTH PARK TAX SERVICES LLC v STEPPING STONE PROPERTIES LLC ET.AL. |

| STEPPING STONE PROPERTIES LLC |

% BRIAN STARK-STAT.AGT. |

DEFENDANT |

CV-06-582451 |

PLYMOUTH PARK TAX SERVICES LLC v STEPPING STONE PROPERTIES LLC ET.AL. |

Brian and Paul Stark sure have a lot of damn nerve hosting a radio show on Real Estate.

REAL ESTATE RADIO is the long running radio show that teaches you the ins and outs of buying and selling commercial and residential real estate properties.

In today's economy, you may be lead to believe that the real estate market is not a profitable venture. Nothing could be further from the truth...if you know what you're doing. REAL ESTATE RADIO well help you better understand today's real estate market so you can be profitable.

REAL ESTATE RADIO is hosted by two of the most prolific real estate proprietors in the local area, Paul and Brian Stark. With over 40 years experience between the two of them, Paul and Brian Stark have a proven track record for making money in the real estate market. As the proprietors of multiple local companies all within the Real Estate business, the Stark brothers have become experts in all phases of the current market. Whether you need information on how to choose a property, when to remodel, how to obtain financing or when to sell, the Starks will have the answers to share with you on REAL ESTATE RADIO.

REAL ESTATE RADIO has been airing now for over 10 years on WERE 1490AM. In that time, REAL ESTATE RADIO has not only made a lot of people money with it's sound advice for listeners, but has featured many of the best guests how have their own success stories in the real estate market. Over the years, their list of guests have included both business people and local politicians who have shared their vast knowledge of the inner workings of good, and bad business deals. This list of guests has included: Arnold Pinkney, Congresswoman Stephanie Tubbs-Jones, Cleveland City Councilmen Mike Polensek and Mike Dolan, Cleveland Public Library Director Andrew Venable, Cuyahoga Public Library Director Sari Feldman, International speaker and success trainer Brian Tracy, Franklin Covey Founder Hyrum Smith, New York Times Best Selling Author, syndicated columnist and television personality Larry Elder, Best Selling Author Matthew Lesko, Publisher of the real estate industry Slatin Report Peter Slatin and many more!

REAL ESTATE RADIO is heard on Thursdays from 7pm-8pm on 1490AM, WERE (NewsTalkCleveland). Tune in weekly, or download our podcast if you ever miss a show or just need it as a reference for your next business deal!

May all your deals be profitable!

http://www.starkradio.com/

- Name

- Brian Stark

- Company

- Trustar Funding

- E-mail

- Contact Brian Stark (Trustar Funding)

- Website

- http://www.trustarfunding.com

- Office Phone

- (216) 531-5310 x 14

- Cell Phone

- (216) 310-1470

- Fax

- (888) 833-5860

- Address

- 17000 St. Clair Avenue, Cleveland, OH, 44110

- Description

- Private, direct real estate lender. We arrange as a broker what we cannot close as a direct lender.

About Us:

Trustar Funding - Real Estate Financiers...

·Trustar Funding is a Private, Direct Real Estate Lender. We make loans to real estate investors, on houses and small commercial properties in Northern Ohio, and the New York / New Jersey metro areas.

·Transactional Funding: 100% funding, nationwide, for back-to-back closings. we lend 100% of the purchase price of ANY property, where there is a pre-arranged, immediate back-to-back sale of that property to another party, in the same escrow, on the same business day. 100% Funding, nationwide.

·Professional Commercial Real Estate Mortgage Brokerage. We arrange, as a broker, all types of commercial real estate finance, on ALL commercial property types, Nationwide. Multi family, office, retail, single use, hospitality, land, etc.

·Loan Servicing. Are you making a loan to another party, and need underwriting, proper documentation, loan origination and servicing? Trustar Funding provides all of these services for 3rd parties as well.

Brian Stark is a PRIVATE LENDER who can NOT AFFORD TO PAY HIS OWN PROPERTY TAXES ON SEVERAL PROPERTIES:

Private Money Lender Details

http://www.privatemoneylendingguide.com/images/advisors_bg_top.jpg

); width: 763px; padding: 23px 0px 0px 2px; font-size: 12px; line-height: 16px; min-height: 127px; margin: 0px 0px 30px; background-repeat: no-repeat no-repeat;">

Company Description

We make loans to Real Estate Investors on residential and small commercial properties in decent suburban communities in Ohio, from Columbus North & in the New York/New Jersey Metro market. We also make Transactional Funding loans on all property types, Nationwide.

Types of Loans:

Commercial — NJ, NY, OH

Multi-Family — NJ, NY

Office Building — NJ, NY, OH

Rehab — NJ, NY, OH

Residential — NJ, NY, OH

Retail — NJ, NY, OH

Shopping Centers — NJ, NY, OH

Transactional — Nationwide

http://www.privatemoneylendingguide.com/borrowers/lenders/detail.php?advisor_id=000014

This must be one hell of a Real Estate Radio Show.

Sounds more like a con artist to me. A con artist who ripped off Cuyahoga County for tens of thousands in delinquent property taxes.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Brian Stark - Trustee for Cleveland Restoration Society

Brain Stark is a Trustee for the Cleveland Restoration Society:

http://www.clevelandrestoration.org/about/board_members.php

This historic building was left to rot while in the ownership of Brian Stark's LLC for over 10 years:

http://johncochrancoaching.com/coaching-team/

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Brian Stark- bragging about 103 Million $ fund

Brain D Stark is bragging about the 103 MILLION $ fund, yet he can't pay property taxes or bills.

He must be too busy hosting the Real Estate Radio Show.

Stark Group LLC should be criminally prosecuted for their shady real estate transactions in Cuyahoga County.

Stark Group LLC cost Cuyahoga County hundreds of thousands of dollars in delinquent property taxes, demolition cost, blight, court fines and costs, and loss of mortgage funds.

The fact that these losers continue on with a radio show to advise others on real estate after leaving behind mass destruction for others to pay to clean up, along with a major hit on property taxes, is a big smack in the face.

Stark Group LLC members should be prosecuted just like Blaine Murphy was prosecuted, convicted and recently sentenced to prison.

I believe the conduct of Stark Group LLC is worse than Blaine Murphy. Having a radio show on buying/selling real estate, bragging about a 100 million dollar portfolio, and advertising as a hard money lender while others pay to clean up their mess should cause Brian Stark, Paul Stark, and other members of Stark Group LLC to take a nice vacation with Big Bubba.

“He bought homes and sold homes with reckless abandon,” Assistant Cuyahoga County Prosecutor Greg Mussman said. “And it was for greed.”

http://blog.cuyahogalandbank.org/2013/05/house-flipper-blaine-murphy-sentenced-to-two-years-in-prison-plain-dealer/

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Stark Group housing code violations - fines UNPAID

Stark Group had several cases filed in Cleveland Housing Court for violations:

In case # 2005 CRB 014978 Stark Group LLC was fined $30,165.00

Brian Stark appeared in court:

A judgment was transferred for this case to case # 2008 CVH 006899.

And another hefty housing violaton fine:

And another:

And more housing code violation cases for Stepping Stone Properities LLC with hefty fines:

Brian Stark from Stark Group LLC and Stepping Stone Properties LLC shouldn't be advising follks about real estate on any radio show.

He must be giving advice on how to get away with paying property taxes and mortgage - while leaving his slum property behind for others to clean up his mess.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Stark Group delinquent taxes $ 227,439.36 for 2 more properties

Stark Group LLC owned the property located at 245-249 East 156th Street since June 16, 2000.

Stark Group LLC paid NO property taxes since the June 16, 2000 transfer.

Stark Group LLC failed to maintain their property which led to a demolition.

The demolition cost and the unpaid property taxes total $ 117,807.36

This property is now owned by the City of Cleveland's Land Bank:

And county taxpayers are footing the $117,807.36 bill for this multi-millionaire and his real estate radio show.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

NO property taxes paid since the June 16, 2000 transfer.

Stark Group failed to maintain this property also. The demolition , grass cutting fees, and delinquent property taxes cost Cuyahoga County $ 109,632.02

This property is now owned by the Cuyahoga County Land Bank and the delinquent property taxes, demo fee, and grass cutting fees have been wiped out and reduced to $0.

Stark Group LLC ripped Cuyahoga County off for another $227,439.36 - for TWO of their many properties.

The multi-millionaire with a real estate radio show is really doing a number on Cuyahoga County.

I think the FBI needs to do a thorough investigation of the many property transactions for Stark Group LLC, Stepping Stone LLC, and several other highly suspicous LLCs that were involved with numerous real estate transactions with the Stark Group. Group of con artists.

584 real estate transactions for Stark Group LLC:

Your search of stark group return 584 result(s)

Your search of stepping stone return 23 result(s

Numerous properties that touched the hands of Stark Group LLC have a long history of delinquent property taxes. Many are now in the county's land bank and their taxes have been wiped out and reduced to $0.

Hundreds of thousands of dollars in delinquent property taxes.

There is highly suspicous activity with Stark Group LLC and Classic Funding LLC.

Your search of classic funding return 1453 result(s)

And with DLS Group LLC Your search of dls return 99 result(s)

Several other LLCs that have dealt with Stark Group LLC appear highly suspicous also.

Something is really wrong with the way this multi-millionaire real estate radio show host conducts his business, and it is costing Cuyahoga County BIG $$

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Stark Group of Con Artists

Brian Stark is a firm believer in success. He reads aloud from self-help books and keeps a poster listing "21 Suggestions for Success" framed in his sunlit office.

http://www.clevescene.com/cleveland/flop-jocks/Content?oid=1494157

"I am also a nightclub singer!" the site boasts. These con artists that ripped off Cuyahoga County should stick to singing. I bet they suck at that too.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Exploitation - is the name of the game

When do "investors" get that "exploitation" is not a strategy ? It's sick, inhumane...diabolical...

http://realneo.us/content/cuyahoga-county-property-taxes-some-folks-are-forced-pay-and-others-3025-west-25th-street

Thieving communities

....

Sadly - Ward 14 - where this photo was taken along Fulton Ave. - has been played by the former councilman who continues to bully and control his old neighborhood...still waiting on that movie....

http://realneo.us/content/garden-ave-movie-or-law-and-order-tv-dramatization

Con Artist in control of Land Bank needs to be removed asap

I am getting tired of repeating the same ole line.

The Cuyahoga County Land Bank can not save Cuyahoga County from the foreclosure crisis when the president of the land bank is a con artist who has engaged in the exact same behavior as Brian Stark and his LLC's.

Gus Frangos has engaged in several counts of mortage fraud. He is hiding property behind numerous LLCs that do NOT pay property taxes or the mortgage.

MORTAGE FRAUD committed by Gus Frangos http://realneo.us/content/cuyahoga-county-land-bank-president-gus-frangos-con-artist-forges-documents-obtain-2nd-mortg

Links to several issues with the con artist Frangos http://realneo.us/content/cuyahoga-county-land-bank-meeting-june-28-2013-disrupt-it-demand-immediate-removal-gus-frang

Just because Jim Rokakis appointed the con artist to this six figure salary position doesn't mean the con artist should not be removed IMMEDIATELY.

People should question why the hell Jim Rokakis would employee this con artist first in the Treasurer's Office and then appoint the con artist as top dog at the land bank. http://realneo.us/content/cuyahoga-county-land-bank-creators-dabble-ten-million-dollar-property-jim-rokakis-gus-frango

I already caught the con artist lying and trying to falsify his involvement http://realneo.us/content/cuyahoga-county-land-bank-president-gus-frangos-liar-liar-panties-fire-attempted-cover-progr

The Stark Group LIVE radio show is targeted for an audience of "largely upper middle income white".

The largerly upper middle income white property owners get a free ride for their property taxes.

If the property owner is poor, black and owes petty amounts of delinquent property taxes, they are fucked.

And my research will PROVE selective property tax enforcement and Civil Rights violations of the Federal Fair Housing Act http://realneo.us/content/cuyahoga-county-delinquent-property-tax-lien-sale-flaw-system-or-violation-civil-rights-fair

Nearly three years ago, I provided my research to the NAACP c/o Stan Miller. The NAACP did not provide any assistance to the victims and turned them away when I sent the victims to the office of NAACP.

I also had a meeting with East Cleveland Councilman Nathaniel Martin nearly three years ago and provided my research.

Councilman Martin personally delivered my research to George Forbes homes. No result.

The victims below all owned their houses for over 50 YEARS. Two of the properties were owned mortage free. All stolen for petty delinquent property taxes.

And the 'upper middle income white" property owner, who hosts a radio show on real estate, gets a free ride on his property taxes for TEN YEARS.

I also discussed the selective property tax enforcement with former East Cleveland Mayor Eric Brewer.

Brewer knows the truth and tried to stop this years ago:

I wrote him a letter in 2006 asking that he not sell anymore properties through third-party tax lien sales to GLS Capital and Plymouth Park Investments out of East Cleveland. Mayor Frank Jackson had also asked him not to sell tax liens from Cleveland.

I was critical of Rokakis pushing this blight-causing deal in 1999 when I hosted a radio show on WERE. I think it's absolutely horrible how he, as an elected official, pushed for a tax lien sale state law that created blight in East Cleveland by letting third party investors sit on vacant properties without cutting the grass, boarding them up, maintaining or rehabilitating them. If Steve Litt wants to write a real story, investigate Rokakis' third party tax lien sales and the impact they've had on school district budgets. He claimed it helps the schools but empty houses don't generate property taxes. Rokakis' policies have done much to decimate the East Cleveland school district's budget and that of every other community in Cuyahoga County where he's been selling tax liens to third party investors.

I had some blocks with 37 properties and 25 delapidated vacancies. Every year we had to divert general fund and HUD dollars from other purposes just to take care of abandoned properties. Go to Rokakis' website. He won't update the "tax lien certificate sales" information past 2006 because it will show just how his policies have devasted the county. Through 2006 it shows he sold the tax liens to 22912 properties from East Cleveland, Cleveland and other cities throughout the county. How many tax liens has Rokakis sold over the past four years? That's the number he's hiding from the public. He has refused to allow the individual tax delinquent homeowner to buy their own tax lien at up to a 30 percent discount, but he sells their tax lien to a third-party for that amount. Steve Litt. This is the real story.

I did not automatically buy into Rokakis' countywide landbank program because by his own rules, it doesn't help East Cleveland. Additionally, he told me in 2006 during a meeting coordinated by Jimmy Dimora, Tim Hagan and Peter Lawson Jones, that he had $250,000 in demolition funds for East Cleveland that was to be funded through monies controlled by him and Bill Mason. Mason, however, had the final authority to say yes or no. When I followed-up with Rokakis, after I shared "his" promise with council and the residents, he said Mason decided to use the funds for another purpose and I ended up with egg on my face. From then on I viewed everything he told me with skepticism.

It's positions llike those described above that made some view me as abrasive. Anyone who fights for poor people or a predominantly Black city that has been disrespected, used and abused by everyone is always viewed as abrasive, and so is anyone who stands up to the Plain Dealer.

http://blog.cleveland.com/metro/2010/02/new_mayor_gary_norton_hopes_to.html

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Stark Enterprises - take the money and run

nuCLEus is still a joke and Stark Enterprises luxury Beachwood apartment complex is a preview of the workmanship we can expect downtown:

https://www.news5cleveland.com/news/local-news/oh-cuyahoga/luxury-beachwood-apartment-complex-floods-again-residents-fed-up

http://www.crainscleveland.com/article/20170205/news/170209905/250-million-stark-nucleus-project-stalled-alive

Stark is also the shadow partner on "Villa Hispana"